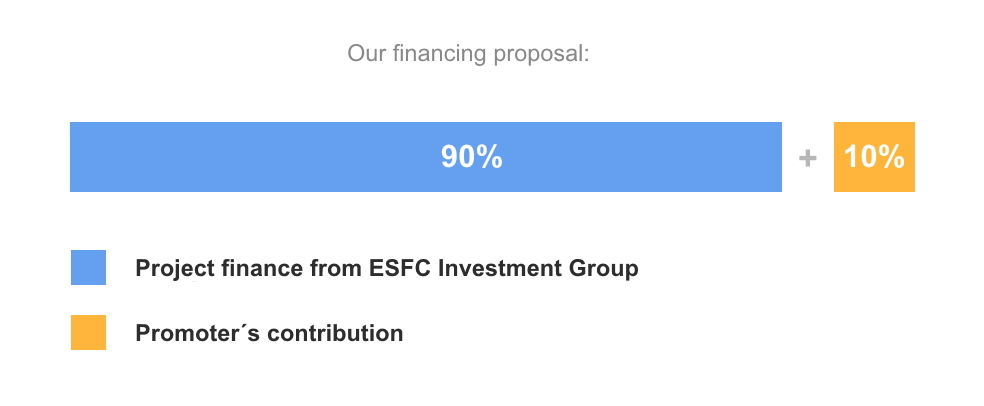

Lending up to 90%

Lending up to 90% of the Project Cost

Link Bridge Financial LTDA is a reliable financial partner, ready to offer clients project financing in the form of a flexible long-term loan, taking into account previously incurred expenses.Our financial instruments provide financing for up to 90% of investment costs with a maturity of up to 20 years.

The financing model we offer may include investment costs previously incurred by customers.

Example of 90% funding:

• The total cost of the investment project is €100 million.• About €10 million has already been spent on the project.

• The Project Initiator can apply for a loan of €90 million.

If the Project Initiator has no assets (for example, land, money, buildings, etc.) application are not considered.

The minimum loan amount is $ /€ 5 million or equivalent, with no maximum limit.

Big business owners plan for decades to come, but in the modern world, the financial health of companies can change drastically in a matter of days, despite “reliable” forecasts or studies. Financial crises, pandemics, tensions between countries and funding freezes are becoming important factors that businesses need to consider.

Why companies may need additional funding:

Construction risk. Typically, the source of debt repayment in project finance schemes is the cash flow generated by the future object. Any violation of construction plans can lead to certain financial problems requiring additional funds.

Operational risk. Violation of the operation and maintenance of the facility as a result of contractor errors or other factors is associated with a serious financial risk.

Supply risk. Many projects depend on a continuous supply of materials, fuels and other resources. If the volume of supplies or the cost of resources have changed, we are ready to help.

Economic risk. Slowdown of the national and world economy, lockdown, changes in market conditions and exchange rates are reflected in the prospects of the investment project.

Political risk. Developing countries are especially sensitive to geopolitical shocks. Risks such as nationalization and expropriation of property, sanctions, military conflicts, business restrictions and unstable legislation can affect the financial health of companies.

Practice shows that underfunding of investment projects is closely related to factors such as improper planning and assessment of investment needs and the use of multiple sources of funds.

Our company is ready to provide flexible loans that compensate for up to 90% of the investment costs incurred by the Project Initiator.

We finance investment projects in the energy, infrastructure, industry, agriculture, mining and processing of minerals, oil and gas sector, chemical waste processing, real estate and tourism.

Contact us to find more.

We will consider your question as soon as possible, and our experts will help to solve the tasks