Investment project assessment services

Costex Corporation DBA offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

Assessing the attractiveness of investment projects in this process is becoming increasingly important, helping businesses make the right decisions.

LBFL Investment Gruop, a company with international experience, offers large businesses professional assistance and support in the field of investment engineering and consulting.

We also offer corporate clients with services such as lending, project finance, loan guarantees, financial modeling, project management, etc.

LBFL, with its and foreign partners, is ready to assist you in the construction and modernization of large facilities under the EPC contract.

To find out more, contact our representatives and get a free consultation at any convenient time.

Methods and approaches to assessing the attractiveness of investment projects

In the context of investment consulting, the assessment of the attractiveness of investment projects has quantitative and qualitative aspects.This depends, among other things, on the objectives of the investor, which may be expressed, for example, in obtaining the maximum possible income or the strategic expansion of the business and the conquest of new markets.

The criteria and methods used today in investment consulting are well developed and widely used in practice. The essence of modern methods is presented below.

Table: Summary of the main methods for assessing the attractiveness of investment projects.

| Project assessment method | Brief description |

| Project net present value (NPV) method | Discounting the cash flows of a project at a rate that reflects the expected level of interest on a loan in the financial market. |

| Payback period (PP) method | Calculation of the period during which the income, discounted at the end of the project, will be equal to the total investment. |

| Internal rate of return (IRR) method | The method is based on the calculation of the discount rate at which the net present value is zero. |

| Profitability index (PI) and investment efficiency ratio (ARR) method | Estimation of the ratio of discounted net income to initial investment, along with an assessment of the ratio of the average annual profit of the project to the average amount of investment. |

| Capital Asset Pricing Model (CAPM) | Estimation of the potential profitability of a portfolio of securities (shares), taking into account the restrictions of the investment period. The method does not take into account possible changes in risk and profitability over time. |

| Comparison of project return with the weighted average cost of capital (WACC) | The project is considered viable if the expected return exceeds the weighted average cost of capital. The method cannot take into account differences in the risk level of projects, therefore it is not suitable for comparing investment alternatives. |

| Best possible state method | This method is a modified net present value (NPV) method. It uses a discount rate for cash flows adjusted for project risk. |

| "Arbitrage" theory of investment project evaluation | The method is based on assessing the impact of market risk on the investment portfolio, along with external factors such as inflation, industrial production growth, etc. |

| Simplified discounting based on the concept of strategic net present value | Cash flows are presented as a simple linear function of the rate of return on liquid assets. |

Despite the extensive financial tools, there is currently no unified decision-making system in investment engineering.

Different projects are evaluated by different teams based on specific methods, indicators and criteria, taking into account the specific sector and the interests of the project participants.

The use of advanced methods for assessing the attractiveness of investment projects involves the use of many formulas and criteria. For example, when evaluating financing models for long-term projects, it is necessary to take into account the change in the cost of financial resources over time, possible scenarios for attracting resources, their legal regulation, etc.

At the same time, specialists in the field of investment consulting need to choose one of the best options based on the specific conditions of the project.

The financial literature indicates that any financing mechanism is based on the financial model of an investment project, which should be built with a thorough analysis of all factors affecting a particular project.

The model constructed in this way allows not only to calculate the result with the given forecast parameters and draw up financial reports, but also to choose the most suitable investment schemes and sources of financing in accordance with the established criteria and the wishes of investors.

Multi-criteria assessment of the effectiveness of investment projects

Financial methods for evaluating projects, including NPV and IRR methods, are aimed at calculating the financial effects from the implementation of an investment project.The decision criteria based on them allow answering the question of whether the investment being assessed is financially beneficial for the participants. However, modern project performance analysis cannot focus solely on the financial effects of a project as measured by the cash flows it generates.

Traditional cost-benefit methods only provide information about the cost-effectiveness of a project in financial terms, so they do not include any non-financial benefits or losses (eg environmental or social).

They also do not take into account the external impacts of the project on other stakeholders. In fact, financial methods represent a major simplification compared to integrated methods.

The implementation of a large investment project (especially at the international level) can have negative consequences for the enterprise in unexpected areas of activity that the project does not directly affect. In other words, the project may disrupt other aspects of the company's (region's) activities, despite the fact that the project itself formally remains financially profitable.

A comprehensive analysis that takes into account the impact of the project both on other investments and on the ongoing activities of the participants is not possible using isolated methods of financial analysis. These shortcomings of the traditional financial approach to assessing the attractiveness of investment projects encourage researchers to look for new approaches based on both financial and non-financial criteria (multi-criteria approach).

In practice, the use of multi-criteria methods for assessing the attractiveness of projects is associated with certain methodological difficulties, such as:

• Choosing the right set of non-financial criteria. The choice of criteria for evaluating the attractiveness of a project should be comprehensive, taking into account organizational, financial, marketing, technical, resource and other aspects.

• Assigning adequate weight to all evaluation criteria. The problem of ranking is to assign a certain "weight" to the criteria objectively and reasonably, in accordance with their real value for a particular project.

• The procedure associated with making an investment decision based on one or more investment criteria that are significant for the participants.

So, multi-criteria methods take into account not only financial, but also other significant factors, including economic and social factors. It is more appropriate to use an integrated approach, since the term "profitability" is usually associated with an assessment of a financial nature.

Theoretically, two ways are possible.

Firstly, the assessment of the attractiveness of an investment project is made on the basis of a number of criteria, but the final investment decision is made on the basis of one chosen criterion, which is considered the main one.

Secondly, the assessment is carried out on the basis of several criteria with different "weights", and then the decision will require a more complex approach.

Experts in the field of investment engineering and consulting can help the client understand the intricacies of analysis and evaluation, choosing the decision-making model for a particular sector, business and project.

Considering the scale of potential financial, reputational and other losses, cooperation with specialized teams seems justified, especially for large international investments.

Expected benefits of the project for potential investors

The financial model of any large investment project has two components.These include analysis of capital investments and analysis of cash flows during the implementation of the project.

Capital investments can be made not only in the initial period, but also during the subsequent period, depending on its scale and financing scheme.

When considering real investments, it is necessary to predict both the engineering and commercial parts. This can be explained the fact that real investment projects have clear discrete technical and financial characteristics.

It is impossible to make a final investment decision without forecasting cost indicators. To solve the latter problem, it is necessary to conduct comprehensive pre-investment marketing research. The development of methods for assessing the attractiveness of investment projects requires linking the expected benefits of the project, business planning and comprehensive financial analysis.

Analysis of the expected benefits of the project is now considered widespread in investment engineering.

The task of the finance team is to build a model that most accurately relates the potential benefits and losses of participants with the so-called utility index. The role of such a model lies in the fact that it can be used as a guideline in making an informed decision that meets not only the intentions and interests of the investor, but also his project partners.

The following algorithm is used to determine the expected benefit of the investment:

1. At the first stage, the financial team calculates the potential benefit of each of the results in the context of making an investment decision.

2. At the second stage, each expected result of the project is linked to its probability in order to bring the calculations closer to reality.

3. The results of the calculations for each of the compared projects are used to compare the total expected benefits.

The expected benefit of investment projects is an important indicator for making the right decision, which allows companies to take into account the benefits of each investment and the associated risk.

The construction of such a model for capital-intensive real investment projects has unique features.

In investment engineering, a collegial decision is usually used for such projects. It follows that the "utility" function itself must be of a generalized nature. For example, it is the weighted average of the utility functions of the participants involved in making an investment decision, based on the degree of responsibility or share of the partner in the project.

The theory of the expected benefit allows to a certain extent to formalize the procedure for measuring the level of risk. It assumes that the same benefit will be attributed to a given outcome, regardless of the time of its occurrence. If risk adjustments are made intuitively, then the value assigned to the result may vary depending on the time frame and the specifics of the project.

Experts consider it extremely unlikely that an intuitive procedure could replace the complex calculations required to evaluate the benefits of large investment projects.

Therefore, the use of mathematical tools makes it possible to make investment decisions more reasonable.

Below we list the main factors that should be considered when evaluating the attractiveness of real investment projects and comparing them in terms of expected benefits for participants. If you need professional advice or support in the field of investment consulting, please contact us at any time.

What to consider when assessing the investment attractiveness of a project

The basis for building a model of the expected benefits of the project is business planning, which at the stages of a feasibility study describes the prerequisites for the project, a specific action plan for investors, and also determines the financial characteristics and possible results of the project.The structure of a business plan in international investment practice may vary slightly, but most of the key planning points are similar and differ only in the structure and content of some elements.

Among the key elements of a business plan, the most important in predicting economic performance is the marketing plan. This document contains an assessment of the market opportunities of the enterprise. The volume of sales of products (services) with its forecasting is most important, because market analysis and the forecast of the formation of the level and structure of demand for products predetermine the result of the project.

The results of marketing research are also the basis for the development of a long-term strategy and short-term tactics of the company, determine the future needs for financial resources.

The marketing plan is the basis for predicting the commercial results of the project, since without predicted sales volumes and an understanding of the market price assessment, it is impossible to judge the correctness of investment decisions.

The primary task in assessing the investment attractiveness of projects is to determine the criteria for the viability of investments.

To date, experts have proposed several dozen such criteria (more than 50), which are used to varying degrees in the practice of investment engineering.

The groups of criteria for investment attractiveness of projects include:

• Criteria of efficiency of capital investments.

• Criteria for the effectiveness of the use of equity capital.

• Criteria for the effectiveness of the use of credit funds.

• Criteria of profitability of investments and the like.

At the stage of substantiating investment decisions, it is not always possible to calculate all the coefficients due to the lack of initial information, although at this stage general conclusions about the project may be sufficient.

When evaluating the effectiveness of large long-term projects, it is important to calculate the criteria for borrowed capital based on depreciation in the income stream without taking into account the liquidation value.

For modernization projects that involve only the replacement of equipment with service lives close to the forecast period, the characteristics of the project should be determined taking into account depreciation deductions and the salvage value of the equipment.

Financial analysis of the effectiveness of investment projects

Large capital investments usually require the attraction of borrowed resources, since few companies have enough free funds that can be frozen for a long-term project with a high risk and uncertainty.In addition, the cost of internal financial resources may be significantly higher compared to loans.

The high cost of internal resources can be explained by the lost profit from a more profitable alternative allocation of capital. Since the lost profit is difficult to determine for the conditions of the real sector, the company's own resources can be considered "cheap" up to a certain limit.

Financial analysis of the effectiveness of projects, taking into account borrowed capital, should be carried out as part of a comprehensive assessment of the attractiveness of investment projects. It should be taken into account that the decrease in the weighted average cost of capital has a positive effect on the efficiency of the adopted project.

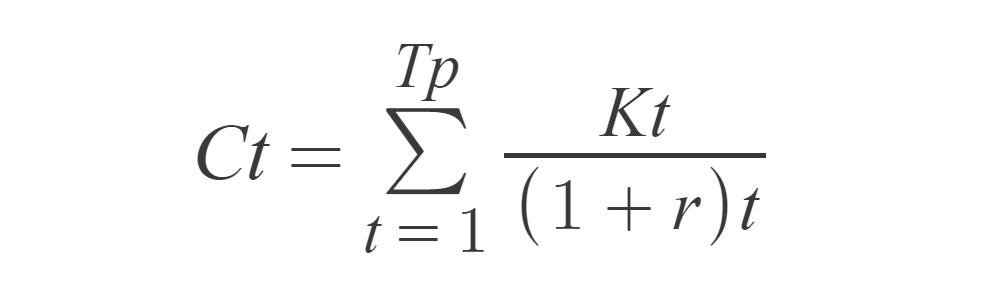

The discounted flow of expenses for servicing borrowed capital is determined by the following formula, increasing over time:

Сt – the amount of borrowed funds attracted at the beginning of the t period;

Tr – the total period of project implementation from drawings to the start of operation;

t – the period or step of discounting the flow of project costs;

r – the discount rate.

Finance teams should be aware that even during the operational phase there are significant capital costs that must also be taken into account.

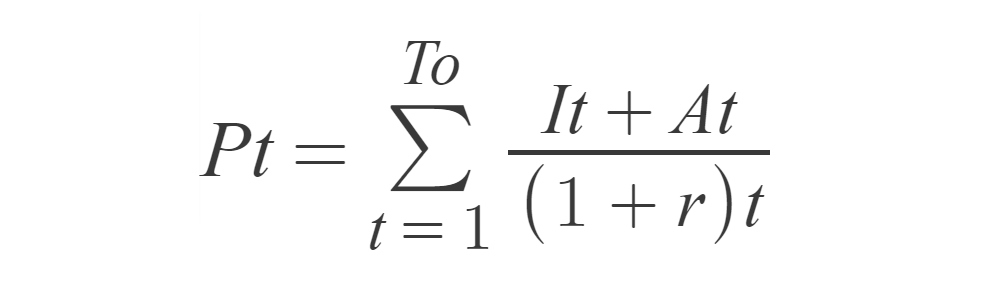

The discounted income flow is calculated by the following formula:

Pt – the net profit of the project for t period;

At – depreciation charges for the corresponding period;

Тo – the expected lifetime of the facility.

It should also be taken into account that the discount rates in the respective calculations will differ. The reason for this is the time gap. Expenses are usually incurred by project participants at the beginning of the investment period, and financial results are calculated at the end of the period.

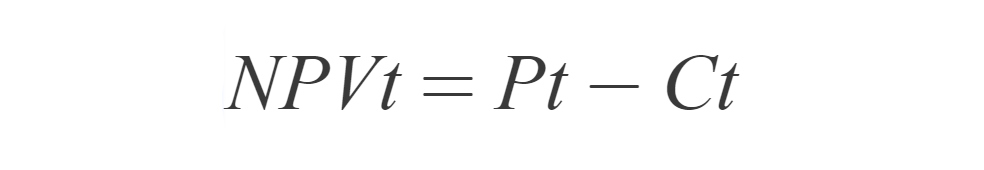

Given the above formulas, the net present value is calculated as follows:

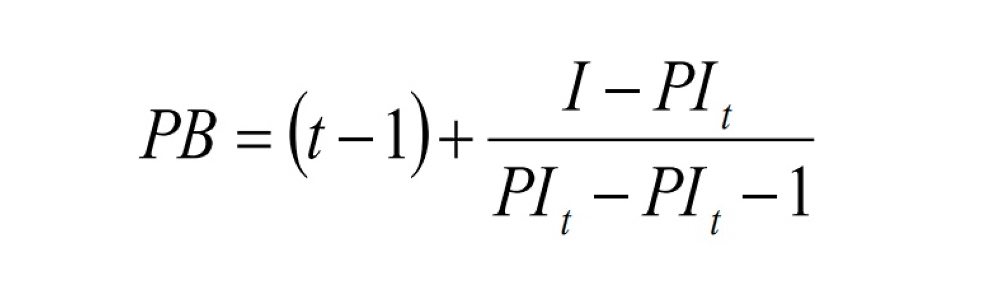

The payback period of investment projects is calculated as follows:

PIt – the index of profitability of this investment project.

An important indicator for assessing the attractiveness of investment projects is the margin of financial stability, which is defined as the ratio of retained earnings to gross profit from sales. It characterizes the company's ability to attract the resources for the development of production.

The metrics used in equity performance analyzes are intended for operating companies and projects.

The following criteria are generally recommended to justify investment decisions:

• Dividends that can be received by project participants for the entire forecast period, taking into account the stage of engineering design, construction, commissioning of the facility and reaching the design capacity.

• Relative change in the cost of equity capital on debt, due to the influence of various external and internal factors.

Another important issue in assessing the attractiveness of a project is the search for the optimal ratio of equity and debt capital required for the implementation of the project. This ratio is determined by the technical and economic characteristics of the project and the specific investment scenario. A decrease in the share of equity capital automatically leads to an increase in external borrowing.

The assessment of the potential profitability of capital investments is carried out on the basis of a set of two dozen financial indicators, the role of which varies depending on the industry, the specific purpose of the project and other factors.

The main criteria for the profitability of capital investments are:

• Return on equity, which is mathematically determined by the ratio of the company's net income to the amount of assets, expressed as a percentage.

• Gross margin, which allows you to determine the amount of profit available to cover mandatory payments, as well as to trace the interaction of market factors such as price, production volume or demand for the project.

• The profitability of products sold is determined by the ratio of net profit to the cost of products sold; this indicator shows the income received per unit of product sold.

• The asset turnover ratio is determined by the ratio of the cost of products sold to the price of assets; it shows how effectively existing assets are used to increase sales.

A serious obstacle hindering the investment activity of a business may be limited access to financial resources.

This point is important to consider for specialists involved in investment design.

Limited access to capital requires companies to adopt a special strategy to ensure development in the face of limited resources and even forces them to abandon projects with a positive outlook.

There are three possible scenarios of limited financial resources:

• Relative limitation (short-term or long-term): funds not invested in the considered set of investment projects can be invested in another area with an acceptable return.

• An absolute limitation only exists when, at any given time, a company either does not have access to the necessary resources, regardless of interest rates, or is unwilling to invest more than a certain amount of funds.

A professional assessment of the attractiveness of an investment project using advanced methods helps a business to answer the question of the viability of an investment and rationally use the available funds.

In the real sector, this problem deserves high priority, given the scale of potential losses resulting from poor decision making.

If you are in need of investment advisory, financial modeling or project management services, please contact an Costex Corporation DBA representative.

We offer long-term loans for large projects in energy sector, mining, real estate, agriculture and industry around the world.

Find out more about our opportunities.