Attraction of investments and bank loans for businesses

Costex Corporation DBA offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

Thanks to attracting investment and competent lending, production and exports are growing, competitiveness is strengthening, products are improving, new jobs are being created and economic growth is supported.

Companies that can attract large investments most often become leaders in the field of modern technologies, applying innovative solutions and progressive methods of business management.

In the context of growing global competition, the ability of a business to successfully implement capital-intensive projects, increase production and sales, and control investment risks are of great importance.

Financial company Costex Corporation DBA provides large long-term loans for businesses on favorable terms, organizes project financing (PF) for large investment projects.

We also offer professional advisory services for European and foreign companies on any issues related to the implementation of investment projects.

Our clients include dozens of companies from the EU, USA, Latin America, Africa, East Asia and the Middle East, successfully operating in sectors such as renewable energy, mining and processing of minerals, oil and gas sector, agriculture, infrastructure, industry and tourism.

Cooperation with our company can give an impressive effect in the form of increasing investments, their scale and efficiency.

We propose to follow global trends, applying the achievements of financial engineering to improve the results of commercial and industrial activities.

The importance of investments for businesses

Almost any business success starts with an investment decision.This is often a tricky and not obvious decision, which can be fraught with risk and uncertainty. Therefore, not all players make them in a timely manner and not all of these decisions are correct.

However, it is difficult to argue with the fact that investment is critical for both big business and the public sector.

To assess and predict the propensity of companies to invest, international financial institutions have developed various indicators that measure the willingness of entrepreneurs to face future challenges. Investment means business development, job creation, increased consumption, increased opportunities for capital investment and the chance to achieve high economic results in the future.

Ways to support this kind of action at the state and corporate level boil down to creating optimal conditions for choosing the right strategy and following it.

Factors so important that the stability of legislation, access to qualified personnel, cost of capital, sources of investment support and infrastructure aspects are of paramount importance.

In a period of rapid technological progress, companies need investments to implement new technologies that are emerging in the industry. Without investments in, for example, new high-performance production lines, robotics and automation, modern companies can no longer compete in most international markets.

Every new or improved product that the company intends to bring to the market will also require capital expenditures and smart financial decisions.

The purpose of investment is to increase fixed capital, or at least to counteract consumption-induced decline. In the first case, we are talking about investments in development, in the second we are talking about investments for substitution.

There are a number of investment arguments that have a real impact on people's quality of life and business potential. Significant financial investments in manufacturing processes allow for the production of higher quality capital-intensive products on a large scale. Investments give businesses a chance to prosper in the future, while increasing the standard of living of society by increasing consumption.

However, in order to create this chance, we need to attract investments or credit funds today.

Globally, investment is the only sustainable source of long-term growth. Consumption (both private and public) increases current economic growth.

However, if the production capacity of an economy cannot meet current needs, this can destabilize it. Exports, in turn, are sensitive to changes in the situation abroad.

Investment is the most important component of sustainable growth, not only in the context of laying the foundations for future prosperity, but also in order to catch up with economic leaders in development.

Lack of investment for business and government is a serious loss that is difficult to compensate, because the investment process is inextricably linked with time. Lack of investment today can mean a permanent loss of promising business opportunities. Investment drives innovation.

This, in turn, allows for the modernization of production, that is, to change its structure towards advanced technologies, products and services, and to increase competitiveness.

2020 required large companies to provide more effective technical, organizational and economic solutions for the survival and prosperity of their business. Market leaders have picked up on this trend. R&D investment is skyrocketing, helping companies adapt to new realities.

For example, Amazon's investment in R&D was twice the budget of the British capital - about $ 42.7 billion a year.

Obviously, without investment in innovation, there is no more development.

From the point of view of a modern enterprise, attracting investment means much more than just increasing profitability and reducing business risks. With investments that increase production capacity, companies can achieve optimal scale of operations and benefits. This is a condition for survival.

Companies and governments in general cannot achieve satisfactory economic growth without investment in fixed assets. Any workplace consists of machines, devices, buildings, infrastructure, and software used to perform production tasks. Investment requires savings. If the company does not mobilize internal resources for this purpose, financing of projects falls on the shoulders of investors and lenders.

This way of financing a business entails certain costs and risks, but external funding can quickly pay off if borrowed funds are used correctly.

Ways to attract investment for large business

There are several main ways to attract investments, such as corporatization of an enterprise, irrevocable financial assistance in the form of tax credits, interest-free soft loans, debt financing (including traditional bank loans), as well as financing under government programs (subventions, subsidies, grants, targeted government assistance).All these tools are used by big business.

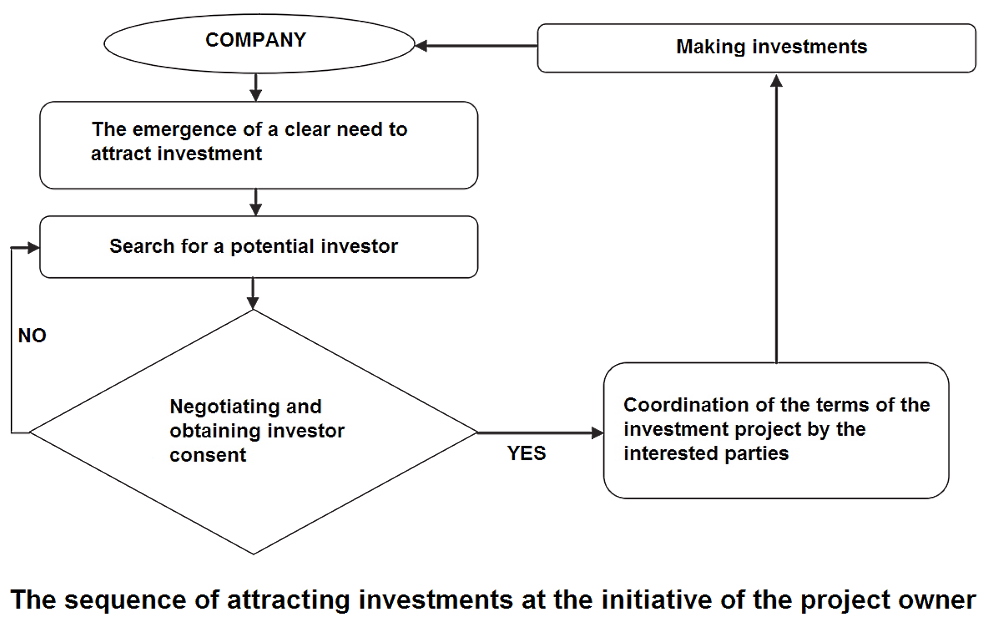

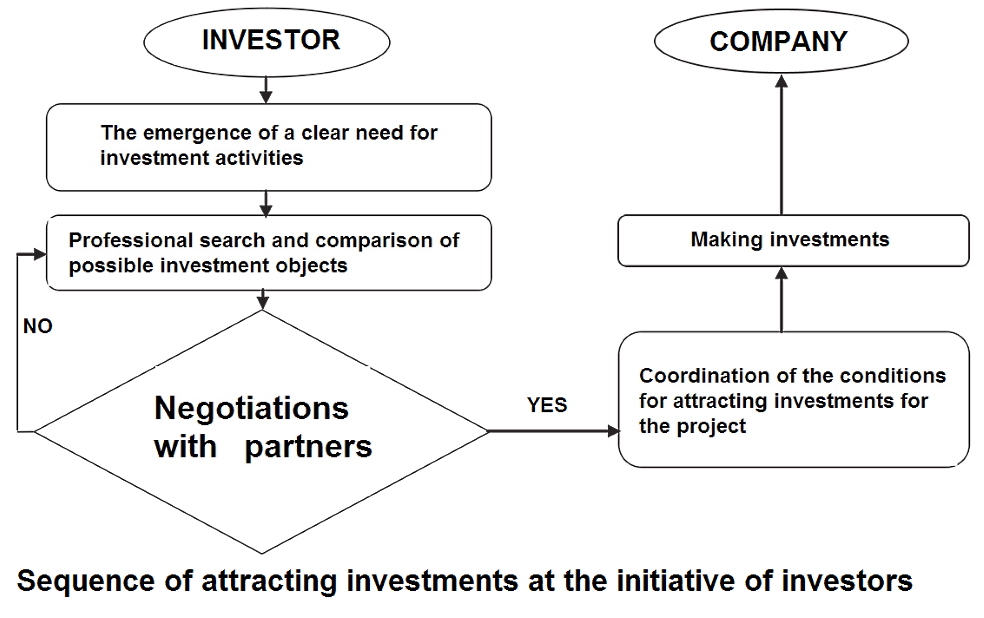

Since attracting investments is considered as a step-by-step process with a strictly defined sequence of actions, we have formulated two possible schemes for financing business projects, depending on the initiator of a particular project (either the investor or the owner of the project).

Scheme 1:

Scheme 2:

Analytical studies conducted by international financial institutions highlight the key motivations for investors or investment decision makers when planning business expansion, including opening foreign branches and setting up joint ventures abroad.

These factors include the following:

• Development of new markets for product sales.

• More efficient use of available internal resources of the company.

• Bringing the company closer to existing markets and strengthening its competitiveness.

• Striving to conduct business with a stable legal and economic environment.

• Taking advantage of favorable investment opportunities.

• Gaining access to promising labor markets, etc.

The above motivations mostly relate to investors who are interested in doing business in developed countries of Europe, USA, Canada and other stable markets.

Since these markets are highly competitive, have a long-standing culture of entrepreneurship with high standards and traditions, attracting foreign investment in such an environment is usually not difficult.

In recent years, effective investment attraction has become an increasingly difficult task not only for developing countries, but also for developed industrial markets.

The investment is beneficial for both parties, including the investee and the party offering additional capital. A company that attracts foreign investment can count on outstripping growth in key indicators, while capital providers are aiming for high returns, optimizing operations and reducing costs.

At the same time, a significant number of risks remain, which limit investment in foreign projects.

These risks are usually caused by factors such as high levels of corruption, imperfect national legislation, political instability, trade restrictions, sanctions, and the like.

However, many companies are interested in investing in developing countries, which is mainly related to the need to reduce production costs, growing market potential and long-term development prospects. At the same time, they use terms such as "growing markets", "mature markets" or "promising markets." On the opposite side, there are “high risk markets” or “declining markets”. Each of them dictates specific requirements to investors.

To better understand the limitations of the latter, below we have listed the most important factors hindering the implementation of investment projects:

• Difficulty finding a market niche.

• Having strong competitors in the host country.

• An oversaturated market, which does not apply to investments in the field of re-export or cooperative activities.

• High prices for real estate, materials, products, services and other resources for investment activity.

• Rising labor costs (wages and other cost components).

• Unfavorable legal regulations concerning economic activity.

• Restrictions on the use of internal company resources.

• Instability of legislation and tax system.

• High level of corruption, etc.

The hierarchy of specific business requirements for investment activities may vary depending on the type of investor, the sector of economic activity, a specific country and type of market, the duration of the planned investment project, as well as the stability and predictability of certain conditions.

Table: Some forms of attracting investments for large businesses.

| Investment form | Ways to attract investment | Known issues and risks |

| Budget financing | Providing funds from state and local budgets on a non-refundable basis, redistributing budget payments and providing tax incentives. | Low risk. A serious drawback of this scheme is considered to be imperfect mechanisms and excessive bureaucratization of budgetary policy, as well as a chronic shortage of funds. |

| Self-financing of projects | The use of retained earnings for the implementation of investment projects, as well as the reinvestment of non-current assets, the issue of securities, and the owner's contribution to the authorized capital | Average level of risk. The difficulty of mobilizing internal resources and a shortage of working capital at the enterprise. |

| Debt financing | Interest-free loans from government and international financial institutions, loans, venture financing, leasing and bond placement. | High risk. Lack of security and insufficient investment attractiveness of the project may become a problem. |

Attracting foreign investment for large projects

Foreign investment plays an important role in the development of any country, region, industry or specific enterprise.The importance of foreign investment has increased significantly in recent decades, when the developing countries rapidly integrated into the global economy and required a colossal flow of technological and financial resources to ensure continuous growth and market saturation.

The term "foreign investment" is considered in the context of international law and national legislation of the host country, which regulates the legal basis for property rights, ownership and disposal of assets.

In world practice, such a term is understood as any investments abroad, which provide for some degree of investor control over the enterprise.

It is important to distinguish between public and private foreign investment originating from different sources. Public investments include, inter alia, loans that one state or group of states provides to its foreign partners. Private investment means all funds that private firms, companies or citizens of one country provide to their partners from another country. These relations are governed by the relevant international treaties applying the principles of international law.

Foreign direct investment (FDI) currently accounts for a significant proportion of foreign investment.

They involve an investment of resources that ensures constant participation in the business, thanks to which the investor retains control over investment projects. According to the World Bank, the largest volume of foreign direct investment in the world was recorded in the pre-crisis 2007 ($ 3.13 trillion).

Foreign investors are any entities that carry out investment activities in the territory of which they are residents. These entities can be various legal entities, foreign individuals, foreign states or other subjects of investment activity in accordance with local legislation.

A clear legal definition of the circle of foreign investors is of practical importance for several reasons.

First, a foreign investor receives direct financial benefits in many situations.

Secondly, the subject gets access to tenders or other events for the successful implementation of entrepreneurial activities in the territory of the host country.

Finally, the legal status guarantees the investor reliable protection at the international level.

Among the features of modern investment activities at the international level, the following can be mentioned:

• Close relationship of foreign investment with the ongoing internationalization of business.

• Rapid transformation of the sectoral structure of the economy through investment in services, trade and finance.

• Changing the ways of financing large projects and improving the international investment climate.

Foreign investments can be carried out in the form of a flow of foreign exchange, transfers of real estate or movable property, shares, securities and corporate rights, assignment of the right to claim fulfillment of contractual obligations, transfer of technology and intellectual property rights.

At the same time, the implementation of investment activities in the territory of another country requires professional legal support, which is explained by the complexity and heterogeneity of legislation, especially in developing countries.

Table: The main strategies for companies to enter the international market.

| Strategy | Brief description, advantages and disadvantages |

| Export strategy | A set of activities that are implemented by foreign companies to enter the foreign market with the offer of relevant goods and services. The advantage of this strategy is the minimal market risk for investors. The disadvantage of exports is that foreign companies still find it difficult to overcome protectionist restrictions in other countries. |

| Cooperation agreements | Conclusion of agreements with foreign companies, according to which the investor provides his tangible and intangible assets (for example, technologies, patents and brands) in exchange for remuneration in various forms. The advantages of this method lie in overcoming customs barriers. This strategy is also characterized by low costs and quick payback. |

| Establishment of a production branch abroad | The creation of our own production branches abroad is carried out through direct foreign investment. The advantages of this approach include the full use of the firm's competitive advantages in a foreign market, but this method requires a lot of resources to enter. FDI is channeled to host countries through the construction of new manufacturing facilities and through acquisitions or takeovers of existing companies abroad. |

| Joint ventures | The advantage of setting up a joint venture in the host country is the minimization of risks and cost savings compared to setting up production branches. The disadvantage is the need for detailed contract work and the complexity of management functions in the implementation of cross-border activities. |

Traditional forms of foreign investment are participation in joint ventures, the acquisition of a share in operating enterprises, the creation of an enterprise wholly owned by foreign investors, the opening of branches or the acquisition of operating enterprises, as well as the acquisition of real estate (buildings, production equipment), land and other resources for implementation of business projects of various formats.

The choice of the format of investment activities abroad largely depends on the type of company, the purpose of the investment, the state and prospects for the development of the market.

Costex Corporation DBA, an international financial company headquartered in Spain, is ready to offer professional service for investment projects of any format around the world.

We provide long-term loans for the implementation of your large investment projects, organize project finance and act as guarantors in international transactions.

Our highly qualified team provides a full range of services for your overseas project.

Sources of funds for business: bank loans and other financial instruments

In the post-crisis period, very few companies have sufficient internal resources that allow them to safely carry out investment activities, especially when it comes to large capital-intensive projects in the energy, infrastructure, oil and gas sector or heavy industry.This problem is solved by attracting external funding, mainly in the form of investment loans, leasing or factoring.

The most obvious solution for most companies is a bank loan, but many potential borrowers face the first problems already at the stage of application. The precarious financial situation, unfavorable market conditions, lack of sufficient liquid assets to provide collateral - all of the above scares off financial institutions and significantly increases the cost of borrowed funds, making the implementation of projects less profitable.

Each business project requires individual financial solutions, depending on the purpose of financing, the timing of the return of funds or other factors.

1. Financing business from internal resources.

The main form of financing costs and investments is the use of internal financial resources.While this may seem like the simplest solution, in practice it comes with some risks. These risks are associated with the need to regularly allocate funds for the company's day-to-day operations. Overuse of this source of business financing leads to financial liquidity problems.

However, practice shows that many SMEs and even large companies strive to maintain a certain level of reserves, considering them as a so-called “financial safety cushion” for emergencies and short-term crises. Accordingly, the business is looking for external support.

2. Bank loans to replenish working capital.

Although lending to working capital is not directly related to the implementation of investment projects, companies may at any time experience difficulties with working capital and need this kind of financial products.This is a basic and fairly simple solution for entrepreneurs who want to further strengthen financing of current business expenses without the risk of suspension of investment projects.

Usually, after signing a loan agreement, the borrower receives the required amount to replenish working capital, and the main part of the loan and interest on it will be paid with each subsequent payment. A working capital loan can also be provided in the form of a revolving line of credit on a checking account. Due to the variety of ready-made solutions, companies can choose the best option for the needs of any business in any situation.

3. Factoring and leasing to support large businesses.

The solution to problems with financial liquidity in the enterprise can also be more advanced banking products, such as factoring.As part of this financial service, the company will receive funds from the factor for the invoice before the payment date set by the partner in the relevant documents. In some cases, the factor may also be responsible for the late payment. This tool is widely used when there is a shortage of working capital.

At first glance, factoring may turn out to be a more complex product for the bank's clients than a loan to replenish working capital. The nature of this product brings significant benefits not only to banks, which gain a better understanding of the company's financial health, but also to customers who are not burdened with recurring payments. This product is recommended for companies with large or permanent contractors.

Long-term invoices can reach millions of euros, which is why such arrears often become a limitation on the day-to-day activities.

Leasing is another popular financial product supporting corporate investment. Large companies use leasing to implement capital-intensive projects with a high percentage of the cost of tangible assets (structures, equipment, vehicles, infrastructure, etc.).

However, the list of assets that can be financed in this way is much broader and covers almost any asset.

4. Large investment loans from 50 million euros for a long term.

Investment loans are becoming more and more popular as the global economy gradually emerges from the crisis.This is a special form of loans, characterized by special conditions for the intended use for the implementation of a specific investment project, for which the lender issues funds.

The purposes for using such loans can be very different. In particular, the borrower, in accordance with the loan agreement, can spend this money on the purchase of production equipment, building materials, renovation of the vehicle fleet or the purchase of real estate to maintain and expand the work of the company. For example, a loan can be issued for the construction of a powerful substation or a new production hall when a plant is expanded.

The most important characteristic of an investment loan for a business is the interest rate, which largely fluctuates depending on the specific investment project, the borrowing company, the requested loan conditions, the term for providing funds, and so on.

Currently, we can observe record low interest rates on long-term loans.

The most important element of success in this case is the correct and reliable assessment of the investment project, which is usually carried out with the assistance of independent experts and specialized companies.

The potential borrower must be confident in the feasibility of the project by presenting any possible outcomes of the project and planning an appropriate strategy for measures to minimize risks and compensate for losses. This is especially true in the case of large international projects.

Loans against a bank guarantee can be an indispensable tool for the implementation of the company's investment policy.

In general, experts distinguish several types of guarantees, but from the point of view of entrepreneurial activity, the main ones will be the guarantee of prepayment, the guarantee of the lease and the guarantee of the proper performance of the contract.

Clients of our financial company can receive guarantees, that is, the partner's obligation to make payment in favor of the beneficiary in the event of violation of the terms of the contract, confirmed by official documents.

Such guarantees are widely used in financing large projects, adding confidence to lenders and facilitating the availability of borrowed funds for businesses.

Which investment attraction option is more suitable for your company?

Discuss details with Costex Corporation DBA consultants.