International financial consulting services

Costex Corporation DBA offers:

• Investment financing from $ /€ 5 million or equivalent and more

• Minimizing the contribution of the project promoter

• Investment loan term up to 20 years

• Credit guarantees

The knowledge and experience of experts helps to choose the most profitable financial solutions in order to implement a new large investment project or accelerate business development.

Financial consulting is an expensive service compared to other types of consulting.

For its money, the business receives a highly qualified team of several narrow-profile financial specialists who do not depend on the company's managers and guarantee an unbiased analysis of existing problems.

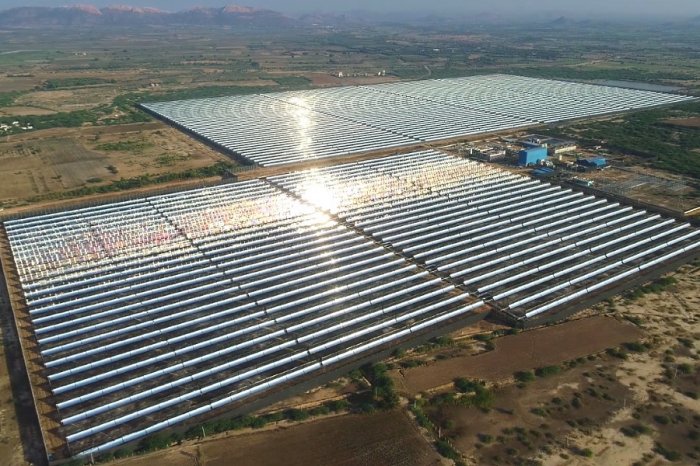

LBFL provides financial consulting services, as well as facilitates the financing of large projects in the energy, transport, oil and gas, mining and processing of minerals, environmental protection, chemical industry and other industries.

In particular, we organize project financing with an initiator's contribution of 10% of the planned cost of the project.

Financial consulting: what is it?

Financial consulting is a comprehensive service offered by specialists who are well aware of the financial market and have experience in investing, choosing the best models for project financing, tax optimization and related issues.A financial advisor can plan finances and correctly analyze the financial position of a company.

Such a specialist has the appropriate education, experience and knowledge of the markets.

Thanks to this, he can find the best solutions for a specific business client or an entire sector, depending on the current situation.

This service can be provided to small, medium and large enterprises operating in various industries. A financial advisor should always be at the client's disposal, ready to find the most profitable financial solutions for the company. Thanks to this, the entrepreneur can benefit from comprehensive professional assistance 24/7.

The main tasks of a financial advisor

The range of services of a financial consultant is very wide, which is explained by different business needs.If you decide to cooperate with LBFL, you can always count on a choice of customized solutions aimed at developing your business.

The most demanded services of a financial advisor include:

• Creation of a financial plan that is adapted to the needs of a particular company.

• Conducting research to accurately determine the financial health of the company and find the best solutions to improve key indicators.

• Finding the best financing options available for the company, including bank loans. A financial consultant will assist the client in negotiating financing terms and take care of formal issues, saving the entrepreneur from time-consuming and tedious procedures.

• Assistance in investing. Professional financial advice always contributes to a higher ROI.

• Advice and clarifications on current financial issues. A financial advisor is at your service at every stage of cooperation and will always be able to give you answers to controversial questions related to the company's finances.

How financial advisors work

Depending on the way the consulting company interacts with the client, financial consulting methods can be classified into expert consulting, project consulting, or ongoing consulting.The most complete range of services is provided in the latter case.

Expert consulting includes the development of a professional financial plan to address specific problems reported by the client. At the same time, the control and implementation of the proposed measures is carried out by the employees of the customer company.

Project consulting begins with defining the client's problem and ends with a package of recommendations for their solution.

The customer is also responsible for implementing the recommended changes in this case.

| Models | Expert consulting | Project consulting | Ongoing Consulting | ||

| Stages | Customer | Advisor | Customer | Advisor | Integrated team |

| Defining a customer problem | + | - | - | + | + |

| Development of recommendations | - | + | - | + | + |

| Organization and implementation of recommended measures | + | - | + | - | + |

Every entrepreneur has different goals and needs, so a business uses the services of a financial advisor in different situations, starting with the formulation of a business idea.

Many business owners associate it with help in the most difficult moments, when the company is on the verge of bankruptcy and is looking for significant funds to survive. However, practice shows that a financial advisor is an extremely useful specialist at all stages of business development.

Benefits of financial consulting for large projects

Companies that do not have experienced staff or resources to comprehensively analyze investment projects often use the services of financial advisors.Hiring outside consultants gives businesses fresh ideas to look at familiar financial models from a different angle. The international company LBFL is also ready to train the customer's personnel on financial issues.

Features of financial consulting for large projects:

• High complexity of this type of consulting, which requires a detailed analysis of several complex business processes with serious preparatory work and justification for each recommended action.

• Providing financial experts with access to reports and other key information that constitutes the company's trade secret. This will require a high level of trust between the consulting company and the client.

• The need for a clear statement of objectives, defining the responsibilities of advisers and responsibility for their improper performance in the process of providing services.

The benefits of hiring an external financial advisor for large projects are numerous. First of all, it is a clear scientific base and a systematic approach to the analysis of the company's financial health. An experienced financier can quickly identify client problems that slow down business development and jeopardize projects.

It is important that the external consultant does not depend on the management of the client company and reports only to his manager.

An objective assessment of the financial situation is exactly what the internal analytical departments of large firms often lack.

Finally, the significant experience gained from other projects will contribute to the effective work of the external consultant. Based on extensive experience, a financial advisor can propose clear and feasible activities for your company.

This type of service covers not only financial issues.

From a broader point of view, financial consulting helps clients make the right decisions for effective business management:

• The client can properly allocate his assets and make the right decisions, for example, regarding investments in new projects.

• The client gets more opportunities to develop his company, relying on effective long-term strategies.

• The client can use the results of financial analysis and plans aimed at the development of the company, taking into account certain conditions.

• The client receives professional support in obtaining the best sources of financing for their projects, as well as in choosing the most suitable bank.

• The client gains access to extensive knowledge of the financial markets.

Should you hire a financial advisor for your new project?

Every senior executive or business owner should answer this question on their own, but there is no doubt that this service is extremely useful in the current uncertainty.

How much does financial advisor service cost?

It is difficult to answer this question unambiguously, because each financial consulting company pursues its own policy and applies different calculation models.Of course, the most popular calculations include the separate cost of financial analysis and other services, as well as additional fees, for example, when obtaining a loan.

Depending on the needs of the business and the range of services used, the client will pay a different price. It is important to find out the conditions in advance with the specialist whose services you are going to use.

Since this market segment is not regulated in most countries, the cost of financial advice is not limited. Typically, a customer using a particular company can incur two types of costs. This is the fee for the financial analysis, as well as the commission that he pays when purchasing a specific financial solution (insurance, loan or other funding).

Depending on the type of services and the complexity of the financial solutions being developed, financial consulting firms can receive from several thousand euros to several hundred thousand euros for their services.

However, companies usually offer financial analysis free of charge as an element of encouraging customers to cooperate.

Pricing policy is associated with a change in the balance of power in the industry.

The more successful a financial consulting company is, the more expensive the services are.

However, in practice, this means an advantage for clients, for example, due to more favorable conditions for obtaining a loan.

But is it a good deal to conduct free financial analysis that will be used to make key business decisions?

It is important to go to the right place without considering the cost of consulting services as a deciding factor.

It is also worth considering the human factor. If you are dealing with a competent financial advisor who thinks about the good of the client, this cooperation definitely makes sense. It doesn't matter if it's free or not.

Our services in the field of financial consulting

The international company LBFL with its partners has participated in the implementation of dozens of major investment projects in many countries around the world.Our team includes some of the best financial consultants in Spain, whose knowledge and experience guarantee the success of your project.

The main principles of the provision of consulting services by professional financial consultants LBFL are:

• Expertise: deep knowledge of the issue on which the consultation is provided.

• Customer interests: following the interests of the client, which are paramount for our team and are valued above the consultant's own interests.

• Customized approach: financial analysis and development of recommendations is carried out individually for each specific client or investment project.

• Informativeness: we always explain to clients the essence of the tools and methods that were used to develop recommendations in order to effectively translate them into subsequent business activities.

• Confidentiality: we guarantee non-disclosure of information received from the client without his consent.

Compliance with ethical standards not only makes it easier to fully develop and analyze the facts to solve a customer problem, but also encourages companies to seek the necessary help from consultants to solve delicate problems.

This aspect of the relationship between the client and the consulting company is formalized by a confidentiality agreement.

We follow strict international standards and principles that apply in the field of financial consulting. You can join a long list of satisfied clients from all over the world who are convinced of the highest professionalism and reliability of LBFL.

Our consulting company does not advertise its services in a way that casts doubt on the client's reputation. The client should receive the most objective and accurate information about the capabilities of the company, the essence of the services and the benefits that he will receive from cooperation with our team.

We put the interests of our clients first and serve them honestly, competently, with respect for their decisions.

A consulting firm in any situation takes an independent position and does everything to ensure that the advice of its experts is based on an impartial consideration of all the facts concerning the case.

Our specialists protect any information related to the client's affairs and collected during the performance of professional duties. All client data is confidential to us and is not used for personal, financial or other interests. The company does not allow unauthorized persons to use these materials or information.

The preliminary research is conducted confidentially under the circumstances and conditions agreed by our company representative and potential client.

Our company cannot provide services to two or more competing clients.

We will certainly inform clients about any connections, circumstances or interests that may affect the opinion of experts or the quality of services.

LBFL only takes orders that match our qualifications and bring real benefits to our customers.

Our company is ready to provide you with a team of qualified specialists who are able to successfully solve your problem.