To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Scientific ideas, innovations and new technologies are becoming the main factors in the development of society, requiring huge investments, rational models of project financing and commercialization of new high-risk technologies.

Are you looking for the best source of funding for a startup or cutting-edge project?

For a long-term investment loan, please contact Link Bridge Financial LTDA.

We are ready to offer a customized financial model for your business, providing comprehensive support for an innovative project anywhere in the world.

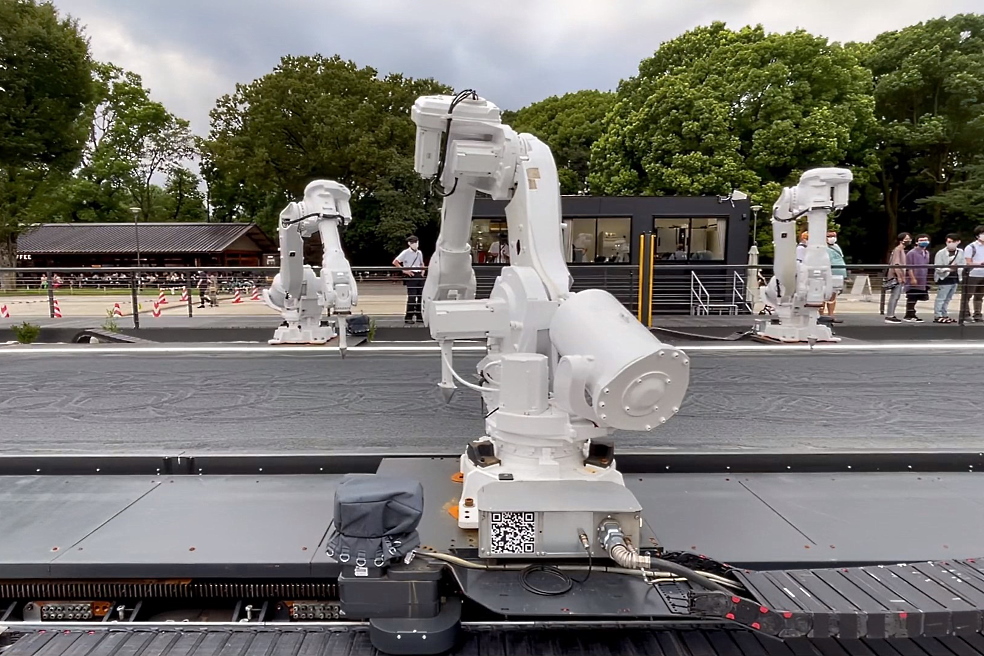

Commercialization of new technologies

The term commercialization is broadly defined as all activities related to the transfer of certain technical knowledge into business practice.Thus, technology commercialization can be defined as the process of supplying the market with innovative technologies. The starting point of the commercialization process is usually an invention or research development. They open up numerous technical and research opportunities but have no market value per se.

Discovering new ways to put inventions into practice creates real business value.

Practical application means the ability to create new or improved products / services, as well as improve existing production, logistics, information processes, etc.

The scale of possible improvements and the range of their potential consumers determines the potential commercial value of scientific research. Therefore, the process of commercialization from the very beginning is associated with a thorough understanding of the benefits of a new product, idea or technology and with an analysis of the potential for their use in the market. These data form the basis of the optimal model for financing an innovative project.

Factors to consider when commercializing new technologies:

• The size of the potential market.

• Detailed characteristics of consumers and access to them.

• Expected investment costs including production costs.

• Intellectual property protection, etc.

If the company allows the development of the proposed and previously analyzed idea into a final product that can be placed on the external or internal market, the process of preparing for the implementation of the project begins.

At the next stage, a prototype is created, which has not yet been tested on the market. At this point, it is critically important to make the final decision on the financing of an innovative project and the choice of the optimal financial model.

In practice, there are such ways of commercializing projects as the sale of property rights, licensing, cooperation agreements, strategic associations, a joint venture, independent implementation or the creation of a new innovative company.

The commercialization strategy has a significant impact on the choice of business model used in the production and marketing of the product.

The process of commercializing a new technology in a broad sense includes the following:

• Generating ideas for products or services.

• Search for sources of financing for an innovative project.

• Research and development work.

• Creation of prototypes based on given technologies.

• Prototype testing and development.

• Search for market applications of new technology and market research.

• Implementation of new technology into practice.

• Product launch and sale.

The commercialization process can be divided into stages, ranging from the creation of a vision of the potential application of the technology to the stage of extending the life of the proposed solution containing the technology.

This includes activities ranging from research, implementation and market elements to building and negotiation to support an evolving project.

Venture capital

In a highly competitive world, the financing of innovative projects plays a critical role in many industries.The development and acquisition of new technological solutions can be financed using venture capital (business angels), as well as investment loans and other instruments, depending on the situation. Often, an additional support tool is state subsidies for investment projects (including the necessary staff training and consulting activities).

Venture capital is a type of medium-term and long-term equity financing, which is provided by investing outside the public capital market.

Therefore, it is intended mainly for small and medium-sized companies that are not listed on the stock exchange and have the potential for rapid growth.

Investments mainly include the acquisition of shares in innovative enterprises by an external investor. They are purchased for the purpose of their subsequent resale in 2-5 years, and the return on invested capital and the potential profit of the investor come mainly from the sale of shares.

In the context of seeking funding for innovative projects, the source of venture capital can be viewed as an additional shareholder that brings new capital to the project in exchange for additional shares. However, a venture investor is not a typical co-owner of a company.

The main features of a venture investor are listed below:

• The venture investor usually does not participate in the day-to-day management of the company, but is given a position on the supervisory board to collect information about the company's activities.

• The venture investor is actually a co-owner who has invested funds for a certain period of 2 to 5 years, and then tries to sell the shares. In most cases, this is a minority shareholder who does not make strategic decisions.

• The venture investor shares responsibility for an innovative project to a certain extent. The situation in which a new co-owner enters a company can be challenging for some companies owned by a single owner, but this is the “price” of obtaining this type of financing.

It is believed that the only source of venture capital is investment funds that specialize in this type of financing for innovative projects.

They are indeed the largest source of this type of capital in many countries, but developed markets offer more opportunities.

However, managers should pay attention to two other sources of venture capital, such as business angels and large companies (industry leaders) acting as investors. These are sources important for financing the commercialization of new technologies in the early stages of development.

Business angels

The term business angels refers to individuals who provide equity capital to new, innovative businesses with high growth potential with whom they share industry interests.In fact, these are entrepreneurs who make venture investments using their own funds. Often these are businessmen who have achieved success in a particular industry in the past. As a result, they have sufficient experience and capital that can be invested in innovative projects of interest.

In this case we are talking about investments that rarely exceed several million euros.

Larger projects need other sources of financing, especially since it is difficult to arrange simultaneous financing of a project by several business angels.

Business angel interests usually include companies offering solutions in the field of alternative energy sources, energy efficiency, IT, biotechnology, etc. All these areas are considered attractive in terms of achieving high growth rates and, accordingly, high profits in the short term.

Business angel investments are especially attractive from the point of view of young companies commercializing new technical solutions.

A significant part of the capital from business angels is invested in the start-up phase of the enterprise and in the phase of its early growth.

Since many investors have significant business experience and business contacts, such partners are valuable for any innovative project. An entrepreneur who invests his personal financial resources is highly motivated to support the project not only with capital, but also with knowledge.

Getting financial support from a business angel is very similar to applying for an investment in a venture capital fund.

In both cases, the investor carefully studies the business plan, the financial and legal structure of the company, the market environment and the potential of the management team in the context of the development of an innovative project.

There are some differences at the beginning of the investment process. The business plan is sent to one of the specialized organizations (the so-called early-stage investor network) that unite this type of investor. These teams "weed out" business plans that do not meet the quality requirements of investors, primarily those that do not provide adequate financial parameters. If the project is approved by the experts, the initiator is invited to a consultation during which the details of the project are discussed, as well as the opportunities and risks associated with it.

At the next stage, the applicant can expect to negotiate directly with potential investors. The rest depends on the agreements between them. However, as with any other venture capital investment, project proponents must carefully evaluate the potential of a particular idea.

The signing of the investment agreement with business angels completes the process.

Large venture capital firms

Corporate venture capital refers to the investment activities carried out by venture capital firms.It is closely related to investing in capital-intensive technological and innovative projects and companies in the early stages of development.

In case of commercial success of a specific project, the next step for the investor (in this case, a large investment firm) may be the development of different forms of cooperation in the field of production, distribution, etc. To this end, partners can create joint ventures or, in some cases, buy out a controlling stake in an innovative company.

Commercialization of new technologies and active involvement in the investment process of a large company with technological and market experience is better than attracting private business angels.

This reduces risks and allows young startups to significantly increase the growth potential of an innovative project based on related technologies.

Venture capital investments received from a large company can bring additional value to enterprises commercializing little-studied technologies, especially if partners operate in the same sector as the investor. In addition to financial resources, it becomes possible to take advantage of the technical and market support of the investor, as well as its distribution channels.

Long-term loans for innovative projects

A long-term investment loan can serve as a source of financing aimed at the introduction of modern technologies.The amount of a technology loan can amount to several million euros, depending on the specific sector, type of project, its novelty and commercial potential.

Novelty in the case of a technology loan is determined by the period of time from which it has been applied in practice.

The generally accepted limitation in such cases is considered to be a period of 5 years of practical application. Under this form of funding, it is usually allowed to acquire new solutions in the form of industrial property rights or R&D services.

The acquired technology must enable the production of new or significantly improved products or the provision of new or significantly improved services. This means that the goal of the project is the implementation of specific technological ideas, and the acquisition of machinery and equipment is to ensure the implementation of this project.

Therefore, a technology loan cannot be used to purchase a fixed asset (machinery, equipment) that uses a new technology.

The use of long-term loans for innovative projects is usually strictly limited to the purposes specified in the loan agreement. A technology loan is actually a form of investment loan. It is provided by commercial banks on the same terms and conditions under which a standard investment loan is usually provided by all corporate clients. This requires the applicant, among other things, to demonstrate high creditworthiness and provide full collateral adequate to the amount of the loan.

As mentioned earlier, a technology loan is a type of investment loan, so the procedure for these funds is almost the same.

However, two additional elements are required:

• Business plan. A high-quality technology investment business plan that accompanies a loan application must be prepared in accordance with specific guidelines.

• Expert opinion on the innovativeness of the project. The conclusion about the technology should be prepared by an experienced scientific team or research center.

Finally, a technology loan is largely commercial in nature and has some features that distinguish it from a conventional bank loan and make it an attractive proposition for innovative companies.

The most important advantage is the write-off of part of the used loan through the “technology bonus”.

Interested in long-term lending for innovative projects?

Looking for support in the commercialization of new technologies?

Contact Link Bridge Financial LTDA for details.