To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The use of advanced financial models of hydroelectric power plants in the planning of investment projects is now becoming of great importance for business.

Having high quality financial forecasts can be a key success factor that will push partners to invest in your multi-million dollar project.

The financial model is an important tool that opens the door to external financing in modern capital markets.

Link Bridge Financial LTDA offers private and public customers professional assistance in financing energy projects around the globe, including long-term bank loans and project finance schemes.

We also develop tailor-made financial solutions for energy sector and other capital intensive areas.

Long-term hydropower plant financial model: theoretical basis

In corporate finance practice, the term "financial model" refers to a comprehensive analytical tool that is used to evaluate and compare projects.This tool is based on initial project data with a set of assumptions that are processed using standard mathematical and statistical methods to obtain the most accurate predictions of future results.

Financial modeling principles include the following:

• Taking into account all significant aspects of the hydropower project and all future events.

• The analysis period should cover the years over which the values of the variables can be predicted with reasonable accuracy.

• The long-term financial model of the hydropower plant should help to generate financial statements (income statement, balance sheet).

• The model must be dynamic, which means that important financial variables can be changed with a corresponding recalculation of the results.

• Revenues and costs for a single project should be modeled separately for each activity.

• The model should take into account the trends observed in real-world projects.

Since the construction of hydropower plants currently requires significant investments (in most cases, at least 2 million euros for 1 MW of installed capacity, taking into account the construction of reservoirs and environmental costs), the role of a high-quality financial model of hydropower plant in the long term can hardly be overestimated.

Most often, such models should cover an investment period of at least 5-7 years.

The stages of forecasting the financial results of the HPP project include:

• Making a set of assumptions for financial analysis.

• Development of a detailed program to maximize profit (electricity sales).

• Forecasting revenues from electricity sales taking into account internal and external factors.

• Forecasting the costs of production and supply / sale of electricity.

• Drawing up a project budget with a plan of expenditures and sources of funds.

• Planning financial costs, taking into account the schedules of loan repayment.

• Drawing up a detailed report on the profit and loss of the project.

• Planning for working capital requirements.

• Drawing up detailed reports on cash flows.

• Determination of the cost of capital.

• Assessment of the effectiveness of the project.

• Risk analysis.

In practice, compiling a financial model for a hydroelectric power plant will require the collection and processing of a large amount of information that is relevant to the future and therefore subject to uncertainty.

This activity requires complex calculations, taking into account changes caused by objective reasons or a change in the position of the project participants on specific issues.

Thus, the level of qualifications, practical experience and technical equipment of the financial team, along with access to project information, determine the result of financial modeling of each project.

Analysis of the financial needs of the hydropower project

To assess the financial viability of a hydroelectric project, a holistic model can be proposed that reflects the structure of revenues and costs for a given type of project in the light of current regulations and market conditions (any significant aspects related to the commercialization of generated energy are important).Assessment of HPP assets is the foundation for subsequent analyzes, because initially it is very important for companies to clearly establish the value that certain investments will add to achieve strategic goals. For this purpose, financial experts use different methods, depending on the specific type of asset and the use of unreliable data that can distort the results and create unnecessary risks.

Currently, a number of economic methods are used to evaluate investment projects for hydropower plants, which can be classified as follows:

• Comparative analysis of projects, which includes an assessment of the cost of a specific project with the assets of competitive projects with similar parameters.

• Valuation of the project using real options, which is most applicable to hydropower projects. This approach provides some flexibility in the future and is based on predicting value in accordance with cash flows that depend on the occurrence of certain events.

• The discounted cash flow method, which evaluates assets (projects) based on an analysis of future cash flows, and then allocates them at an appropriate rate according to the risks of specific flows.

For this type of project, it is necessary to determine the optimal financing scenario in advance.

Since the accuracy of the financial model of a hydroelectric power plant is dependent on the accuracy of the data, a professional approach is essential to success.

Comparative analysis of the financial needs of the project

This is a comparative assessment of the asset value of a hydropower project based on the value of similar assets in the local market.Subsequently, a multiplier system (the ratio between the value of a similar asset and a specific characteristic such as income, profit or production) is used to compare the reference asset with the asset under analysis.

This analysis can be done in two ways.

The first method is related to comparing the HPP project with another asset with similar characteristics.

The second is to compare the performance of mature assets based on past data on the same asset. The mentioned method is simple and easy to use, but it presents certain uncertainties and assumptions, and therefore requires a professional approach.

Investment costs in hydropower projects are divided into the following groups:

• The cost of civil works and site preparation, including the construction of reservoirs. This group is considered the most significant in the context of large projects with a capacity of 100 megawatts and more.

• The cost of electromechanical equipment combined with the cost of professional installation and setup. These costs are especially important in the case of small projects.

In addition, the financial model of a hydroelectric power plant should include significant costs for pre-investment research, design, licensing, study of the impact of the hydroelectric power plant on the environment and reduction of environmental impact, etc.

A comparative analysis of hydropower projects shows that civil construction costs, for example, depend on the cost of labor in the host country. In countries with weak economies, civil construction costs tend to be lower due to the use of cheap labor and local building materials.

In addition, the share of construction work in large projects accounts for more than half of the total cost, while small hydropower plants with an installed capacity of 10 MW or less are mainly dependent on the cost of electromechanical equipment.

Financial valuation through real options

In 1973, Black and Scholes defined for the first time that an option serves as a financial instrument that gives the right, but not the obligation, to buy or sell an asset under specified conditions over a specified period of time.Thus, American financiers have identified two main types of options:

• Options that provide the right to purchase an asset (call options).

• Options, which provide the right to sell an asset (put options) at a fixed price (strike price).

Real options determine the ability to exercise indirect options on real assets, such as the development of a hydroelectric project.

By analogy with the definition of a financial option, a real option can be defined as a right, but not an obligation, to change the initial conditions of an investment project in order to mitigate the evolution of the level of uncertainty of its main variables.

The ability to mitigate the uncertainty associated with the underlying project variables determines the flexibility of the project so that participants have realistic opportunities for action that can be evaluated and corrected over time.

The theory of real options is currently based on the following:

• Investment projects with high uncertainty may have real opportunities to postpone investments, abandon or stage-by-stage build, expand, reduce and replace project elements (operational flexibility).

• Projects can be considered flexible if options for changing their course are identified and can be carried out on conditions acceptable to participants (owners).

• The flexibility inherent in the project increases the value of the investment project.

Unfortunately, hydroelectric power plants lack the high operational flexibility that is typical, for example, for thermal power plants capable of using at least two types of fuel (coal, natural gas, fuel oil, and so on).

HPPs are highly dependent on the natural conditions in the construction area, which carries certain risks.

Commercial flexibility, which largely determines the financial needs of the project, lies in the rules of PPA and the sale of energy, the specifics of building and using a specific financial model of a hydropower plant, and other aspects.

Discounted Cash Flow (DCF) financial valuation

The added value of the hydropower project must be an increase in the capital of the company or the wealth of its shareholders.Thus, appraisal means obtaining economic evidence of a productive asset's ability to generate wealth, whether it be an energy project or another business.

This value is usually correlated with the potential to generate cash flows. A discounted cash flow (DCF) model is used as the basic framework for most analyzes and is the appropriate valuation method because it adequately represents the value creation from the operation of an energy asset over a long period of time.

Cash flow means the result of deducting expenses from income over a specified period of time.

However, since investments in hydropower plants must be assessed taking into account numerous suppliers of capital, it is important to consider the mechanisms of the so-called financial leverage.

Free cash flow is the cash flow generated by a hydropower plant for its beneficiaries, which are financial lenders and partners. Plotting the projected free cash flow is important, but this is only part of the financial assessment, because in order to make the right decision regarding investment in a project, it is necessary to determine the investment decision criteria focused on profitability in the long term. One of the most important elements of a hydropower plant financial model is the rate of return on investment, which deserves careful consideration.

In investment analysis, it is generally accepted that the net present value (NPV) of a project is a measure of the value that a given project will add to a company. Therefore, investing in a project with positive (negative) NPV will increase (decrease) this value.

The general idea is to determine the value of a project based on the net present value of the cash flows it is expected to generate over a given time horizon, adjusted for the discount rate or cost of capital, market conditions, financial structure, and other parameters of the project.

This indicator includes the risk perception of investors in the project and the uncertainty associated with the project, in particular the risk of not achieving expected financial flows.

Typically, it will be higher for high-risk volatile assets and close to the risk-free rate for safer assets with more predictable flows.

In modern finance theory, there is a wide variety of cash flow models that are used, for example, for different purposes. These models should also be taken into account when analyzing the project and predicting the financial performance of the future HPP, taking into account numerous external and internal factors.

Capital structure in a financial model of a hydroelectric power plant

One of the most important tasks at the planning stage of an investment project for a hydroelectric power plant is to determine the capital structure.In this context, experts identify the following criteria:

• Types of capital: a set of sources of financial resources and instruments available to the company that will be used for the construction and launch of the facility.

• Time frame: comparison of specific sources of capital and financial instruments involved in the implementation of the project at different stages. This kind of structure is built on a clear time frame for the start and end of financing / refinancing of the HPP project.

The complexity of the financial decisions taken during the construction and launch of large capital-intensive facilities is due to a number of factors.

The choice of the optimal sources of financing for the HPP project depends on the following:

• A clear understanding of the need for financial resources, the method and time of their receipt, the schedule for the use of funds and settlements with creditors.

• Rational choice of financial instruments, taking into account their availability for a specific project, advantages and disadvantages of use.

• Taking into account the peculiarities of the interaction of various financial sources and instruments, their influence on the effectiveness of each other.

• Understanding the relationship of each funding source and financial instrument to the project's ownership structure and value.

• Minimization of the cost of attracting external financial resources.

• Correct assessment of the risks and constraints of the project.

These aspects require the project participants to take a comprehensive approach to drawing up the financial model of the hydroelectric power plant, constantly monitoring changes and promptly adjusting the relevant parameters within the project structure.

Recommendations for modeling the capital structure

The first step in modeling the capital structure should be a comprehensive study of the activities of the future facility.In particular, it is necessary to assess the project's capital needs and form the conditions for the use of borrowed funds in the interaction of project initiators with contractors, equipment suppliers, authorities, potential investors and creditors (large banks, IFIs).

Based on the data obtained, the participants in the enterprise can outline the circle of the most suitable sources of capital, determine the preconditions for attracting it and estimate the cost of borrowed funds from each source.

This model must be flexible enough to respond to changes in external factors.

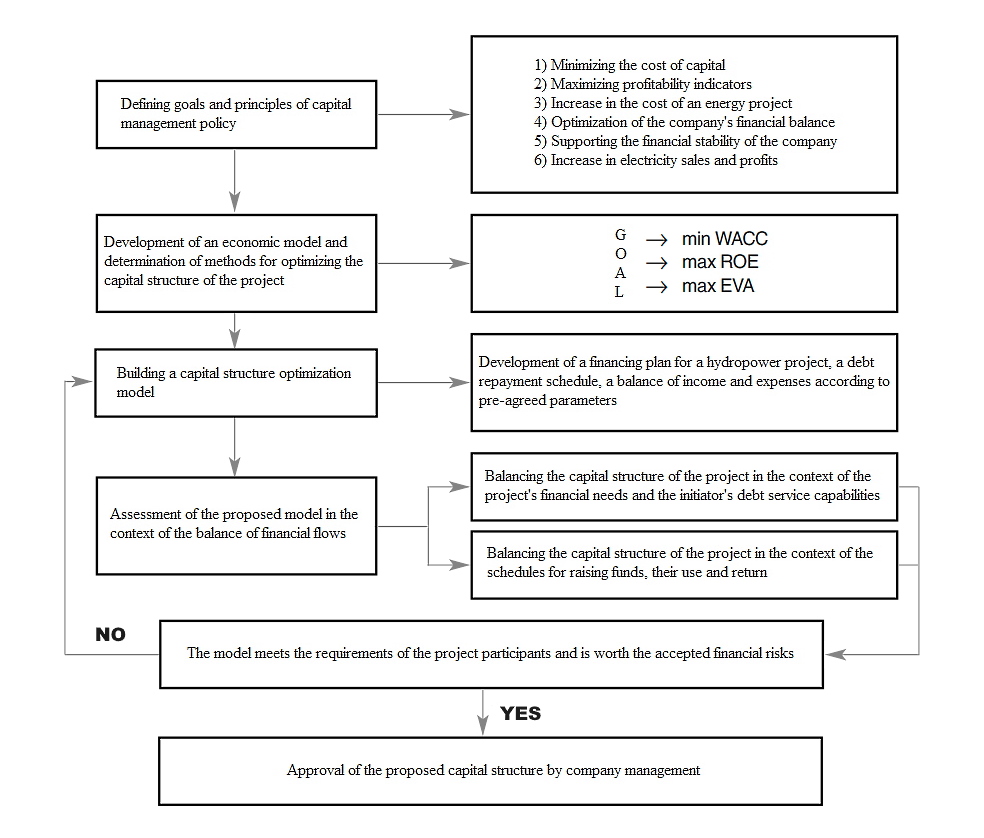

A recommended approach to modeling the capital structure in a financial model of a hydroelectric power plant is shown below. This approach can be easily modified depending on the specific goals of the project participants.

Figure: Algorithm for modeling the capital structure of a hydropower project.

Modeling the capital structure of a HPP project requires taking into account such significant factors as expected income and expenses, the cost of attracting external funds etc.

Potential risks associated with the use of borrowed funds, ranging from a decrease in the company's credit rating to the risk of loss of control over project assets, play a special role in decision-making.

Criteria for optimizing the capital structure of a HPP project

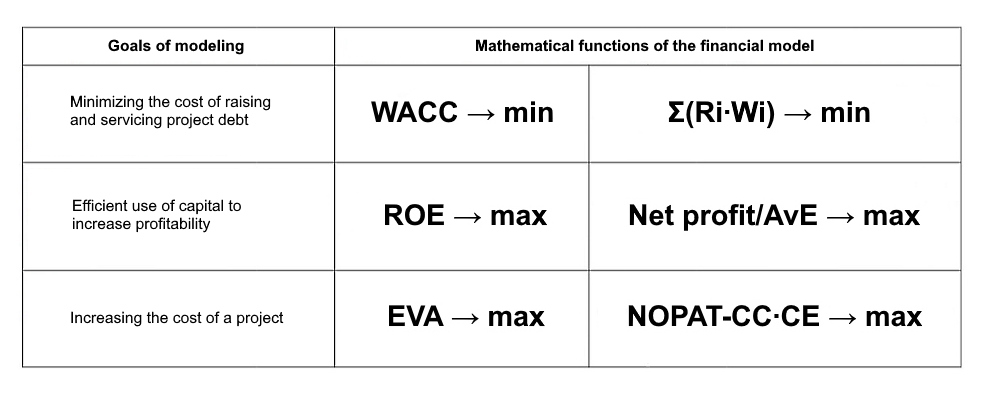

The criteria for optimizing the capital structure are based on the goals of capital management, which are shown in the illustration.Basically, this is the minimization of the cost of borrowed capital, an increase in the return on capital of the company and an increase in net operating profit after the implementation of the project. The focus of this activity determines the ways of optimization and goals, which is displayed in the table below.

Table: Goals of modeling the capital structure of a hydropower project.

WACC – weighted average cost of capital;

EVA – added economic value of the project;

ROE (return on equity) – the return on equity of the initiating company;

NOPAT – net operating profit adjusted taxes and costs of capital servicing;

Wi – the share of a given source of capital or financial instrument in the project;

Ri – the cost of a given source of capital or financial instrument;

CC – the cost of capital;

CE – capital employed;

AvE – average eguity.

Capital management criteria related to the normalization of the financial balance, maintaining the solvency and financial stability of the project will be taken into account, regardless of the main goal of capital management, as restrictive parameters responsible for financial risk.

If the goal of optimizing the capital structure in a financial model of a hydroelectric power plant is to reduce the cost of capital, then the best method would be economic and mathematical modeling using the weighted average cost of capital (WACC) as a key criterion. On the other hand, if the goal of building a financial model is to obtain the maximum profit for the owners, then optimization is carried out on the basis of the return on equity (the effect of financial leverage).

The priority in large projects is the WACC criterion.

This can be explained by the fact that the use of ROE and EVA significantly complicates financial modeling due to the inclusion of profitability indicators in the process.

The latter add an operational component that is more difficult to predict.

When building a financial model, it is important to correctly compare the financing of the project with the planned financial result. The use of indicators of the weighted average cost of capital makes it possible to overcome these difficulties and simplify the solution of the problem of selecting sources of financing and finding the amount of funds raised.

Finding the optimal capital structure in the framework of hydropower projects means comprehensive planning of equity and debt capital, which are united by a common financial strategy. The optimal financial solution for the capital structure is finding such a set and ratio of capital sources, which, for a given financial risk, minimizes the cost of obtaining and servicing capital or ensures the maximum efficiency of its use.

The role of financial models and forecasts in hydropower projects

Financial forecasting means a set of activities through which financial forecasts are made.The subject of forecasting in hydropower projects is financial flows, the models of which are compiled on the basis of initial forecasts of material flows, the most important of which is the forecast of electricity sales, as well as forecasts of consumption of materials, labor, etc.

A predictive model in financial forecasting can be represented as a financial model of a hydroelectric power plant, consisting of a system of equations.

Such models can be developed, for example, for the analysis and comparison of financial statements of several projects, preliminary cash flow estimates, investment cash flow projections and free cash flow projections.

Each of the financial forecasts is created by building a complex financial model as a result of changing a set of one or more initial parameters.

Financial forecasts can be created by specialists of the initiating company or developed under a contract by third-party organizations (contractors, rating agencies, financial analysts, consultants).

Typically, financial modeling of hydropower projects is performed with changes in assumptions about external factors such as economic growth, exchange rates and interest rates. The purpose of making financial forecasts is to reduce risk in the decision-making process.

For example, in the course of forecasting financial statements and assessing future cash flows of hydroelectric power plants on their basis, experts assess the financial needs of the project, which vary depending on external factors, methods and scale of the project, and planned electricity sales.

The source of meeting these financial needs are investments in working capital and fixed assets. This requires making the most rational investment decisions regarding the sources of attracting additional funds. On the other hand, based on cash flow forecasts, HPP investment projects are compared, which makes it possible to decide whether to accept or reject a specific project.

Depending on the objectives of the forecast, qualifications and the level of access of the performers, the composition of the variables included in the financial model of hydropower plants changes.

For external analysis, many parameters are uncontrollable variables, so the role of modeling is reduced.

Table: Types of forecasts in corporate finance and their goals.

| Area | Types of financial forecasts | Forecasting goals |

| Assessment of the financial needs of an investment project |

|

|

| Working capital management |

|

|

| Financial strategy development |

|

|

| Risk management |

|

|

In the literature on financial management of the energy sector, the goal of financial forecasting is reduced only to determining the financial needs of the enterprise.

In practice, this goal is much broader and covers not only the financing of the hydropower project, but also other needs.

Among them are the development of the enterprise, the management of working capital, the formation of the value of the project for investors, as well as the management of project risks of various nature, and much more.

If you are looking for professional financial modeling services for hydropower projects, contact the Link Bridge Financial LTDA team.

Our company provides long-term financing for large projects, offering clients comprehensive support at all stages.