To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

It is a critical element of any large investment project that is required not only by sponsors, but also by potential lenders, contractors and clients.

The construction of a modern fertilizer plant and associated infrastructure typically requires tens of millions of euros, most of which must be raised in the early stages of the project.

Financing capital-intensive projects on the right terms is becoming increasingly challenging in this industry, requiring sponsors to have a perfect business plan, a flexible financial model and guarantees.

Link Bridge Financial LTDA, a company with extensive international experience, offers a full range of professional services for mineral fertilizer producers worldwide, including the following:

• Long-term loans.

• Project finance services.

• Credit guarantees.

• Project management.

• Financial modeling.

• Support and consulting.

Contact our representative for details.

Basics of financial modeling in the mineral fertilizer industry

In general, a financial model is a system of interrelated indicators that can be used to assess the health of a company or its projects.It is aimed at forecasting revenue, cash flow, profit and other important parameters. But the main advantage of financial modeling is the flexibility of the finished product, including the ability of the user to calculate in two clicks how changes in the market or within the company will affect its financial condition.

A high-quality financial model shows all stakeholders how a particular business project works and justifies the level of its expected profitability. This gives confidence to partners, which is especially important in the early stages of cooperation. The financial model is included in the structure of the business plan of the mineral fertilizer plant, being a financial expression of all other elements of a particular investment project.

The financial model helps owners to control the development of the company, and also allows lenders to make a more informed decision on issuing a loan. The financial model is studied by both lenders and investors.

For the latter, not only the idea is important, but also real results and growth.

Since the mineral fertilizer industry is closely linked to agriculture and other sectors of the economy, as well as highly globalized and dependent on numerous factors, the requirements for such a model are very strict. For example, any change in the cost of gas, electricity and logistics immediately affects the operation of mineral fertilizer plants.

The principles of financial modeling applicable to the mineral fertilizer industry are listed below:

• Availability of a certain set of accurate and reliable initial data on the external and internal environment of the investment project.

• Comprehensive assessment of the entire range of available financial resources, taking into account the terms of their attraction and use.

• High-quality assessment of the efficiency of the project under different conditions.

• Sensitivity analysis of the financial plan.

The essence of the financial model can be considered in three aspects, including the feasibility of the project (viability), its overall economic efficiency and sensitivity.

For an ideal financial model of a mineral fertilizer plant, the deterioration of any of its parameters should not have a significant negative impact on key performance indicators.

The model should include several scenarios, such as a baseline, an optimistic scenario, and a pessimistic scenario. For each of them, detailed calculations are made in a certain time horizon. Scenario settings should include all relevant parameters, including exchange rates, tax changes, changes in duties on chemical products and fertilizers, personnel salaries, equipment repair and modernization costs, and other direct and indirect costs.

The more parameters a financial model takes into account, the more accurate its results will be in different scenarios.

Typical sections of the financial model

Given the complexity of the modern mineral fertilizer industry, as well as the versatility of contractual relations between participants in project finance schemes, it is better to entrust the development of a financial model for a large project to a professional team.Regardless of the approach chosen, any financial model should include the following sections:

• Initial data.

• Capital investments.

• Sources of project financing.

• Project cash flows.

• Investment efficiency.

• Sensitivity analysis.

The foundation of any investment project is the correct initial data on which subsequent forecasts and models are based.

This section should contain parameters that directly affect the activity of the project. This includes external factors, internal factors, operating costs, additional sources of income, obligatory payments on loans, as well as forecasts for KPIs based on this data.

| # | Subsection | Brief description | Parameters to consider |

| 1 | Financial forecasts |

This subsection contains a detailed description of the financial performance of an investment project at different stages of its life cycle. The indicators are calculated separately for each business area. In particular, it is important to predict the change in the consumption of mineral fertilizers of a certain type and correctly evaluate the sales plan. Factors such as seasonality, new product introductions and general changes in the global fertilizer market should be considered. |

|

| 2 | Operating costs | In this subsection, it is important to indicate the main cost items that will be required for the operation of a mineral fertilizer plant. |

|

| 3 | Other obligatory project costs | The implementation of any investment project is associated not only with the attraction of borrowed capital, which must be returned within a specified period, but also with numerous taxes, rents and other constant payments. |

|

| 4 | The external environment of the investment project | This subsection of the financial model describes external factors that can affect the business. For example, a local increase in the price of electricity leads to an increase in production costs and can significantly affect the competitiveness of mineral fertilizers of a particular manufacturer in the world market. |

|

With regard to capital investments, this section should reflect the costs of purchasing (creating) long-term assets such as land, premises, infrastructure, production equipment and transport.

For each item, it is important to calculate depreciation costs that will be deducted from revenue.

Since the construction of a mineral fertilizer plant is a very complex engineering project, capital investment consists of many components. The more complex the project (for example, ammonia production or mining facilities), the more capital investment will be required and the more complex the structure of the financial model will be.

The selection of project finance sources is the next important step in model development once the capital costs have been determined and the overall scope of the investment project is understood. Since the cost of building a fertilizer plant from scratch is typically in the tens of millions of euros, project sponsors may need a long-term investment loan and other leverage mechanisms.

This includes the issuance of additional shares and bonds, as well as leasing instruments.

When describing the cash flows of a project, the finance team should systematize all the information from the previous sections and calculate the difference between income (positive cash flow) and expenses (negative cash flow) for the period for which specific model is being developed.

For investors and lenders, this parameter may be more important than profit, as it demonstrates the real financial health of an investment project.

But negative cash flow does not always mean that the company is incurring losses. This situation is normal during the period of business restructuring. In any case, it is important to add a rational explanation for potential providers of capital.

There are three key financial parameters that are important to consider:

1. NPV (Net Present Value) is the sum of cash inflows and outflows at the date the investor would like to make a profit. For example, a year after he invested money. By negative NPV, the investor will understand that the costs of the project exceeded the investments.

2. IRR (Internal Rate of Return) is the rate at which NPV is zero. It demonstrates the average profitability of a mineral fertilizer plant project over a certain period. In other words, IRR reflects the profit that an investor participating in the project will receive.

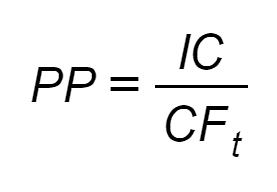

3. PP (payback period) is the minimum period for which the costs of the project will pay off. To correctly calculate this indicator, the team needs to predict how much profit the business will bring each year. The longer the investment pays off, the less attractive it is considered.

Finally, the last important part of the financial model is sensitivity analysis.

It shows how the profit of the enterprise will change under the influence of external factors, which are listed in the first section.

In particular, sensitivity analysis helps to understand how the cost of production will increase with an increase in the foreign exchange rate if the plant buys ammonia from abroad.

External factors in a globalized market cannot be underestimated, especially when it comes to the mineral fertilizer industry. The most recent example is the skyrocketing rise in natural gas prices in Europe, which led to a sharp increase in electricity prices in 2021 and reduced the activity of some plants producing ammonia, one of the main components of nitrogen fertilizers.

Main metrics in the financial model of a mineral fertilizer plant

The attractiveness and viability of any business project is measured by a standard set of parameters that must be reflected in financial model.From the perspective of investors and lenders, key project performance indicators include the following:

• Net present value (NPV).

• Profitability index (PI).

• Internal rate of return (IRR).

• Modified Internal Rate of Return (MIRR).

• Payback period of initial costs (PP).

• PP calculated using discounted cash flows (DPP).

• Weighted average rate of return (ARR).

We'll look at these metrics in more detail below.

Choosing the best investment project based on NPV

The analysis should begin with the net present value method, which is based on a comparison of the present value of investments and the profits generated by the enterprise during the forecast period.The purpose of this method is to identify the real profit that can be obtained as a result of the implementation of a specific project.

Net present value is calculated in several ways:

1. The present value of revenues minus the present value of costs (excluding project financing costs), discounted using the weighted average cost of debt and equity.

2. The present value of cash inflows to shareholders minus the present value of cash outflows from shareholders, discounted at a rate corresponding to the opportunity cost.

3. The present value of profit, discounted at a rate corresponding to the opportunity cost.

All three of the above approaches to some extent reflect the economic essence of the net present value.

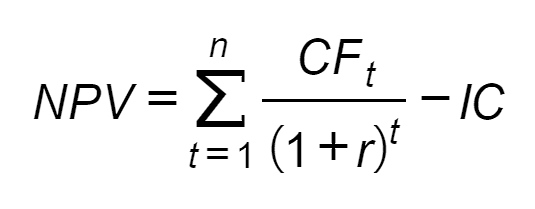

NPV is calculated using the following formula:

CF is the discounted cash flow;

IC is initial investment at the beginning of the project;

r is the discount rate corresponding to the WACC;

n is the discount period;

t is the year of calculation.

This approach to determining NPV assumes the following conditions:

• The volume of investments is accepted as completed;

• The volume of investments is accepted at the time of the analysis;

• The process of return begins after the completion of the project.

The discount rate r can be the bank's lending rate, the weighted average cost of capital, the opportunity cost of capital, and the internal rate of return.

If the analysis is carried out before the start of the investment, then the investment costs should also be brought up to date.

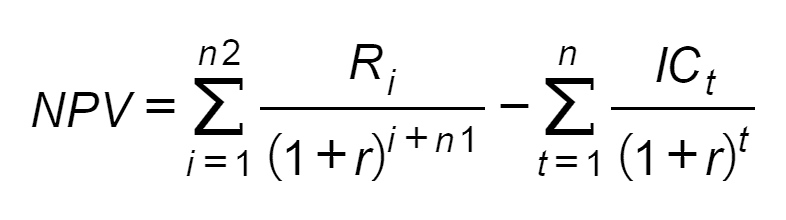

The model for calculating the net present value will take the following form:

ICt is investment costs in period t;

n1 is the duration of the investment period;

n2 is the duration of the return on investment period;

Ri is the income of the project in period i.

The NPV indicator reflects the forecast of changes in the economic potential of a mineral fertilizer producer in the event that an investment decision is made. If NPV is greater than 0, then the project is profitable because it increases the actual value of the company by NPV.

The choice of projects according to the criterion of net present value is based on the following rules:

• If the net present value is positive (NPV is greater than 0), then a financial decision on the project can be made; if the projects are independent and have a positive net present value, then both options can be accepted.

• If NPV=0, then the project is neither profitable nor unprofitable, then from an economic point of view it makes no difference whether or not to accept the project; if the projects are alternative, then the project with the higher net present value is accepted.

• If NPV is less than 0, then the project is unprofitable and should be rejected.

The sense of using this parameter is clear: even if the net present value is zero, then the cash flow generated by the project is sufficient to return the invested capital.

If the net present value is greater than zero, then the mineral fertilizer project generates sufficient profits that belong to the shareholders, and the company's value increases.

The key to calculating net present value, as with other methods of analysis based on discount rates, is to choose the most appropriate rate. It is necessary to take into account the limits of risk-free rates, the projected inflation rate for the period, opportunity costs, uncertainty when planning distant cash flows, etc. The basis for choosing a discount rate in each case is individual and depends on the goals of the analysis, as well as on professional experience and qualifications financial team involved in financial modeling.

By discounting the cash flows, the analyst will be able to ensure that the investment generates greater cash returns than the best available alternatives.

However, the term "best" can be interpreted in different ways.

The "best" option might be, for example, to build an expensive environmentally friendly plant instead of a cheaper traditional facility that can generate maximum profit. In other words, decision-making is not always limited to financial advantages.

After calculating the net present value of a number of projects, the problem of choosing alternative investments of various sizes may arise. In this case, the team cannot ignore the fact that although the net present values of the alternative projects may be close or even the same, they represent very different initial investments. The return on investment index (RI) can be used to compare alternative investments in mineral fertilizer plants.

Other important metrics in the financial model

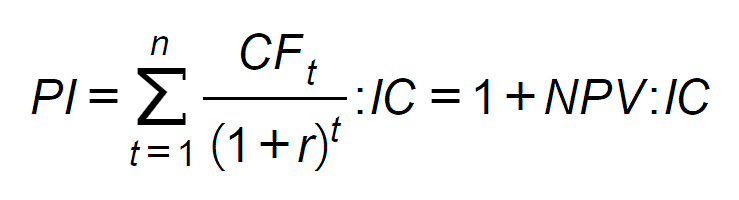

Profitability index means profit per unit of invested funds.It is defined as the ratio of the present value of the cash flow of profits to the present value of investment costs:

Unlike net present value, the profitability index is a relative indicator. It characterizes the level of profit per unit of costs, i.e., the effectiveness of investments. The higher this indicator, the higher the return on each euro invested in the construction and development of the mineral fertilizer plant and its infrastructure.

Due to this, PI is very convenient when choosing one project from a number of alternative projects with similar NPV values. In particular, if two projects have the same NPV values but different costs, then the one that provides greater investment efficiency is more profitable. PI is also widely used in creating an investment portfolio in order to maximize the total value of NPV.

The higher the profitability index, the more preferable the project.

If the index is 1 or lower, then the project hardly meets or even does not meet the minimum requirements (in practice, an index close to one is acceptable in some cases).

PI equal to 1 corresponds to zero net present value.

The profitability index is of limited use in cases where the project requires additional capital investments during the implementation. The initial investment does not reflect total investment costs, as in some cases the company must raise additional funds to launch the facility. Main features of these and other indicators should always be taken into account when developing a financial model for a mineral fertilizer plant or other large projects.

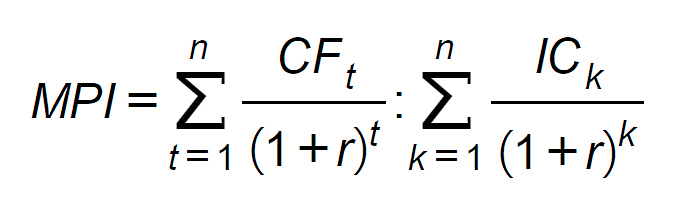

Modified profitability index reflects the increase in investor wealth per unit of initial investment.

If investments come in a constant flow, then MPI can be calculated using the following formula:

where ICk refers to the investment costs in periods k=1,2,...n.

The initial project obligation means the required initial investment plus additional funds that must be accumulated at the beginning of the period for additional investments in subsequent periods. If net cash flows change from positive to negative during the life of a mineral fertilizer project and vice versa, the profitability index and the modified profitability index may differ when comparing the attractiveness of projects.

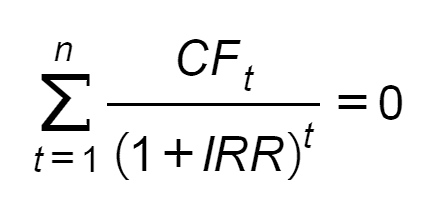

Internal rate of return (IRR, %) is the discount rate at which the present value of the net cash flows is equal to the present value of the investment in the project.

The internal rate of return characterizes the maximum cost of capital to finance a particular project.

The economic meaning of IRR is that the enterprise can make any investment decisions, the profitability of which is not lower than the current value of the cost of capital (CC). The latter means the total cost of the available sources of financing for the project.

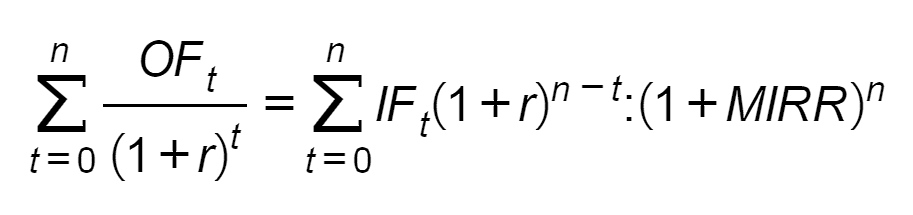

The modified internal rate of return (MIRR) is a discount rate that equates the future value of net cash flows over the project period, calculated at the funding rate, to the present value of the project's investment.

The modified internal rate of return is calculated using the formula:

For evaluating investment projects, MIRR is preferable to IRR in order to assess real profitability of the project or the expected long-term rate of the project.

However, NPV is more useful for the analysis of alternative projects that differ in scale, since it shows how much the optimal project increases the value of a mineral fertilizer company after a successful launch.

The payback period of the initial investment is the period of time required to receive funds from the project in an amount that allows investors to recover the initial costs. Applicable to this type of project, this indicator determines the minimum required life of the mineral fertilizer plant, measured in years. The payback point is the moment after which the current net income becomes positive.

This method is the simplest and therefore widely used. It does not involve discounting cash flows.

The algorithm for calculating the payback period (PP) depends on the uniformity of the projected investment returns.

If the expected income is evenly distributed over the years (periods), then the payback period is calculated using the formula below:

In fact, the payback period (PP) is the ratio of the initial investment (IC) to the value of the annual cash inflow (CFt) for the period of operation of the facility t.

If the calculated payback period is less than the maximum acceptable, then the project is accepted; if not, the investment is rejected. When comparing investment projects, the option with the shortest payback period is considered the best.

How long does it take for a mineral fertilizer plant to pay off?

Typically this period is 5 to 10 years, but specific performance indicators vary widely.

The payback period is one of the most interesting for potential providers of capital, so a good financial model should give an answer to this question.

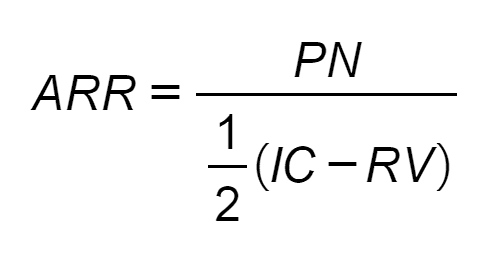

The method of calculating Accounting Rate of Return (ARR) in financial modeling does not involve discounting cash flows and is calculated as the ratio of the average annual expected net profit to the average annual volume of investments. Annual net income is defined as the difference between that year's cash flow and the annual depreciation charge associated with the project.

The simple rate of return can be modified into ARR:

PN is the average annual net profit;

RV is the liquidation value of the project (residual value);

IC is the initial investment.

When comparing investment alternatives, the project with the highest ARR is implemented. At the same time, it is compared with the market rate of interest in order to assess how these investments give a better or worse result compared to other capital investments.

It makes sense to compare the received rates with the actual level of profitability of the company's assets.

Importance of financial modeling services

Most often, the financial model is the basis for the financial forecast and evaluation of the profitability of investment projects in the mineral fertilizer industry and related areas.Thanks to the financial forecast, stakeholders will receive concrete figures about the future financial results of a particular project.

The financial model is also an effective motivational tool for constantly improving business performance.

Liquidity risk is of considerable importance, which is minimized by calculating the projected net cash flows and funding requirements to obtain the most profitable source of project financing. In an increasing number of companies, forecasts are used to determine KPIs.

On the other hand, the assessment of the profitability of an investment is valuable information regarding the decision to participate in this investment project and the study of the financial benefits associated with its implementation.

The financial model of a mineral fertilizer plant is used when attracting investors, applying for a loan, selling a business, or distributing shares between partners.

Link Bridge Financial LTDA is ready to offer the development of a financial model, as well as a company's cash flow forecast for banks and investors.

Our company can also conduct a break-even analysis of the project and a stress test that will show how the financial health of the company will change if key indicators deviate from the plan.

As part of the preparation of the financial model, our company can also carry out calculations of the economic efficiency of your investment project, which include NPV (net present value of the project) and IRR (internal rate of return), as well as building a DCF model of future cash flows from the mineral fertilizer plant.

We don't take a one-size-fits-all approach, but our team develops customized solutions for each client. If the financial model is needed only for internal purposes, we can prepare only a model and a short memorandum.

If the document is being prepared for investors or lenders, we can present your project by supplementing the financial model with the market analysis in which the company operates and a high-quality presentation of the project, highlighting its strengths and advantages.

We operate in many countries such as Spain, France, USA, Germany, Mexico, Saudi Arabia, UAE, Brazil, Argentina, Egypt and others.

For advice and possible financing, please contact Link Bridge Financial LTDA at any time.