To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Mexico has all the prerequisites to become one of the leaders in the development of RES in Latin America in the coming decades, but the country still has a long way to go.

Currently, energy sector relies heavily on large thermal power plants that were built and expanded in the 1980s and 1990s.

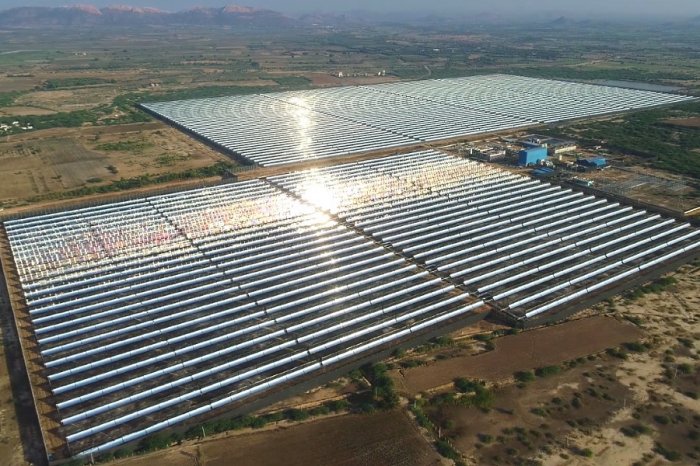

However, financing for renewable energy sector in Mexico is growing every year, driven by fossil fuel prices and the introduction of strict environmental standards. The basis for future development is solar PV plants, which take advantage of powerful solar radiation and vast sparsely populated areas, ideally suited for the construction of energy facilities.

Mexico is making impressive progress in its green energy transition, despite limited financial resources and an imperfect legal framework. In particular, the country is home to the Villanueva Solar Park, one of the largest solar power plants in Latin America.

The gradual development of infrastructure, the introduction of innovative technologies and the creation of a favorable business environment are accompanied by the growth of the investment attractiveness of the Mexican RES sector. At the moment, government institutions, international financial institutions and investment funds, and to a lesser extent commercial banks, play a major role in financing new RES projects.

Link Bridge Financial LTDA is an international company headquartered in Spain, which specializes in financing large investment projects, including RES facilities of various types.

In particular, we offer long-term investment loans for the construction of large solar power plants and wind farms in Mexico. We provide project finance and financial engineering services, as well as provide loan guarantees to our clients.

Contact us for details.

Investing in renewable energy in Mexico: past and future

On a global scale, there has been a steady increase in green energy production in recent decades.Between 2010 and 2019, global RES capacity doubled from 1,226 to 2,537 GW, according to data from the International Renewable Energy Agency (IRENA). After the difficult pandemic years, almost every country in the world has adopted a certain policy that promotes the development of renewable energy sources.

However, clean energy sources have not been adopted to the same extent by different countries of the world, with an obvious concentration of RES investments in the Northern Hemisphere, while in the Southern Hemisphere countries they show slower development. Countries like Uruguay and Costa Rica have really achieved phenomenal success, and almost all of the energy they consume comes from renewable resources.

Mexico is still on the path to a green transition, improving policies and encouraging investment in new solar power plants and wind farms.

Today, the number of people who inhabit Mexico is about 130 million people. A growing economy consumes enormous amounts of energy with ever-increasing demand. The fossil fuel-based energy industry creates a number of negative effects on the environment, including changes in vegetation cover, pollution of inland waters and seas, and greenhouse gas emissions.

For a long time, the country's energy needs were met using traditional energy sources, but huge solar, wind and even geothermal potential create optimal conditions for investment in the RES sector.

Large-scale renewable energy financing will enable Mexico to meet its clean energy goals by increasing energy security, attracting investment, growing economy, and creating high-paying jobs. Investments in renewable energy projects also appear to be the most cost-effective way to electrify rural areas of this large agricultural country and improve the quality of life of local communities.

According to IRENA, installed renewable capacity in Mexico doubled from 2010 to 2019, from 13,515 to 25,650 MW.

Before the pandemic, the country had built 50 solar PV plants located in 15 states, 68 wind farms in 14 states, 4 geothermal projects operating in four states, and 66 hydropower plants located in 15 states across the country.

These numbers are encouraging, but Mexico needs additional efforts to meet the commitments it made in the Paris Agreement, which include a 22% reduction in greenhouse gas emissions and a 51% reduction in soot emissions by 2030.

A recent study by the U.S. The National Renewable Energy Laboratory (NREL) demonstrates three possible scenarios for the development of renewable energy in Mexico until 2024, the parameters of which are listed in the table below.

Table: Renewable energy development scenarios in Mexico until 2024.

| Scenario | Projected growth | Description |

| Business as usual | 531 MW of installed conventional capacity and +4,8 GW of installed RES capacity | Adding of conventional power projects currently underway and renewable projects currently underway or in the pre-commissioning stage. |

| Accelerated renewable energy | + 3.9 GW of installed renewable capacity | A scenario for the accelerated deployment of RES renewable energy projects that are at an advanced stage of licensing, financing, connection or starting construction |

| Accelerated renewable energy+ | + 6.5GW of installed renewable capacity | An acceleration scenario that increases the installed capacity of renewable energy projects that are in earlier stages of development |

Experts consider "business as usual" to be the most realistic scenario, as it involves the balanced development of both conventional thermal power plants and renewable sources based on the real financial capabilities of the Mexican energy sector.

Accelerating the development of RES projects in the near future will require significant regulatory changes and increased investment.

It is especially important to amend local legislation, which still creates certain obstacles for connecting new RES projects to the grid. On the other hand, the implementation of the optimistic scenario for the development of renewable energy will allow Mexico to reduce the prices of solar and wind energy, attract about 17 billion dollars of additional investments and create tens of thousands of new jobs throughout the country.

Natural resources and renewable energy potential in Mexico

Mexico is ideally geographically positioned to become an important regional center for the development of renewable energy.Thanks to natural resources and active state support, the country produced more than 86 TWh of green energy in 2021, which is 26.7% of all electricity production.

In recent decades, government and business have increasingly become involved in financing new ways of producing energy with lower economic cost and less negative impact on the environment. Among the variety of renewable energy sources being developed in Mexico today, hydropower, wind, solar and geothermal energy are the most common.

Biomass energy also plays an important role, as Mexico is a developed agricultural country with a strong livestock sector.

Currently, the potential to increase the installed capacity of RES in Mexico is about 25 TW for solar energy, 3.7 TW for wind energy, and 2.5 GW for geothermal energy. Of great interest to investors are the southeastern states, which have the potential for an additional 5.6 TW of installed solar PV capacity and nearly 750 GW of installed wind capacity.

The use of Mexico's solar energy potential will produce 50,000 TWh of green energy each year, more than 100 times the country's energy needs.

At the same time, the full use of wind potential would allow Mexico to produce about 5,700 TWh of green energy every year.

As the experience of recent years shows, photovoltaics in Mexico is financed and developed most successfully. This can be easily explained by the favorable geographical location. For example, the state of Sonora has up to 7.8 kWh/m2 per day of solar irradiance, and the state has seen exponential growth in the PV sector in recent years. Major companies are investing in the state of Sonora for more efficient use of clean solar energy, but the sector still needs government support.

The growth of funding for hydropower in Mexico has not kept pace with the development of other renewable sources, so the share of hydropower in annual electricity generation has fallen from 20% to 8% compared to the 1990s.

Currently, the country mainly invests in the modernization of old but reliable hydroelectric power plants, without building new large facilities.

Experts estimate Mexico's economically feasible hydropower potential at about 60 TWh of energy each year, while the maximum technical potential reaches 135 TWh.

Looking at the distribution of energy facilities between states, one can see insufficient investment in renewable energy in Colima, Morelos, Tlaxcala, Campeche, Tabasco and Mexico. On the other hand, Northern Baja California, Sonora, Coahuila, San Luis Potosí, Jalisco and Puebla take advantage of three of the four types of renewable energy produced in the country. This uneven distribution indicates that there is room for growth in renewable energy production.

The development of RES infrastructure, the expansion of power grids and the construction of factories for the production of equipment requires a combination of social, political, legal and economic factors. But the most important factor for success is the availability of natural resources that are a source of energy (sun, wind, fast rivers, heat of the earth, etc.).

An example of such success on a global scale can be Indonesia, which has 40% of the world's geothermal energy reserves and is gradually increasing its use.

Mexico has significant potential for the development of renewable energy sources such as hydro, wind, solar and geothermal energy.

The vast, sparsely populated plains are ideal for the construction of wind farms and solar power plants. In particular, in the north of Veracruz or in the north of Baja California there are favorable conditions for wind farms.

The northern part of the country, with its desert climate and low cloud cover, is ideal for using solar energy. The Transversal Neovolcanic Axis, which includes the states of Hidalgo, Guanajuato and Queretaro, is extremely favorable for the development of geothermal energy. In the case of tidal energy, although it is not yet used in Mexico, studies show that the northwest coast of the country has great potential.

Table: Distribution of installed RES capacity in Mexico by state (2021)

| State | Solar energy | State | Wind energy |

| Sonora | 1326 | Oaxaca | 2758 |

| Aguascalientes | 907 | Tamaulipas | 1715 |

| Chihuahua | 828 | Nuevo Leon | 794 |

| Coahuila | 810 | Coahuila | 397 |

| Jalisco | 385 | Yucatan | 245 |

| Guanajuato | 314 | Zacatecas | 230 |

| Durango | 295 | Baja California | 195 |

| Tlaxcala | 220 | Jalisco | 180 |

| San Luis Potosi | 204 | Guanajuato | 105 |

|

Others

|

895 | Others | 537 |

Trends in financing renewable energy projects in Mexico

According to a World Bank report, the average temperature has increased by 1.5ºC compared to pre-industrial levels.Under the Paris Agreement signed in 2015, Mexico committed to reduce its greenhouse gas emissions by 22%, according to the National Inventory of Greenhouse Gas and Compound Emissions of the Ministry of Environment and Natural Resources (SEMARNAT).

It is noted that the energy sector produces more than 40% of these gases. Therefore, every day it becomes more necessary to finance and implement renewable energy projects in Mexico that involve reducing greenhouse gas emissions and ensuring a sustainable future.

Fiscal incentives for RES development have been established in Mexico since 2004.

In particular, accelerated income tax depreciation was included, allowing for 100% depreciation of equipment costs for the use of renewable energy sources during the financial period. For this benefit to be effective, the equipment must be in operation for at least five consecutive years. Several important reforms were implemented in 2013 to liberalize the electricity generation sector, which has historically been controlled by the Federal Commission for Electricity (CFE).

In Mexico, solar power plants, wind farms and other RES projects are financed by loans from large banks, resources of investment funds, as well as long-term instruments from international financial institutions (IFIs).

For example, the World Bank recently provided $100 million for a solar energy project in Mexico, and the Inter-American Development Bank (IDB) provided an $86 million loan for the development of three solar parks. The Development Bank, consisting of the National Bank of Public Works and Services (Banobras), Nacional Financiera (Nafin), among others, financed renewable projects totaling more than 40 billion pesos ($2 billion).

In general, commercial banks are less involved in financing RES projects in Mexico, offering too high interest rates and shorter financing terms.

Today, it is seen as necessary for private companies to have better access to capital markets in order to obtain financial resources. This will bring important benefits to the Mexican markets, such as longer financing for commercial banks and better terms for the capital us, thus achieving a higher level of leverage.

Experts believe that the local securities market should be a more flexible and accessible source of resources for RES companies, creating better conditions for placing shares and attracting long-term capital.

There are several instruments on the market that are used to finance this type of project, such as green bonds or social bonds issued by Mexican organizations. According to the Mexican Carbon Market Platform, the first MéxiCO2 bond was issued in 2015 by Nafin for a period of 5 years with an interest rate of 3.5%. Since 2018, 25 financial instruments have been issued, and 3 instruments with terms from 3 to 10 years have been placed on the international market.

The securities market serves as an important source of refinancing for renewable energy projects in Mexico, bringing significant benefits to both banks and shareholders of RES projects.

By achieving longer financing terms and higher leverage, capital providers free up resources for commercial banks and partners to participate in more projects. The rating given in the market to the securities issued by these projects will be very important.

Obviously, the higher the rating, the more investors will be able to buy these bonds.

Many large investment funds require a minimum rating of a financial instrument to participate in project financing.

Due to the high commercial risk, the market offers several instruments that can be used as cash flow guarantees for projects, for example, the support offered by development agencies such as the Nafin Stock Market Guarantee, instruments of the Multilateral Investment Guarantee Agency (MIGA), a guarantee against political risks, and also CO2 emission reduction certificates and other instruments.

Using the resources obtained from the sale of these certificates, RES market participants can easily structure payment guarantees for issued instruments.

If you are interested in long-term financing for renewable energy projects in Mexico, contact an official Link Bridge Financial LTDA representative in your region and schedule a free consultation.