To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

The long payback period, the uncertainty of the business environment and the changing legal framework for the implementation of green energy projects require a well-considered strategy and effective financial solutions.

Link Bridge Financial LTDA offers flexible long-term financing for green energy projects, including bank loans of 50 million euros or more.

We provide professional services in the field of project finance (PF) and financial modeling, as well as provide our clients with full technical and legal support at any stage of the project. Today our team is ready to provide useful business contacts and rich international investment experience for your business.

We also offer the services of an experienced EPC contractor with a worldwide reputation for the implementation of large projects at a high engineering level on a turnkey basis.

If you are planning the construction (expansion, modernization) of an onshore or offshore wind farm, solar power plant of any type, geothermal power plant or biomass power plant, contact our team for advice.

Investment strategy for green energy projects

The development of green energy has become the dominant trend in the modern economy.Renewable energy sources combine innovative engineering and technical solutions aimed at generating electricity and heat without using scarce fossil fuels.

Green sources such as biogas, sea tide, sun and wind energy contribute to reducing the carbon footprint of the economy. An important role in the transition period is played by facilities generating thermal energy from secondary sources, such as coke oven gas or methane generated during degassing of coal mines.

The development of advanced engineering projects, the construction of new capital-intensive sites and the installation of special equipment for the production of green energy require huge investments in the early stages. A serious problem that hinders the development of renewable energy sources in the world is their insufficient investment provision. Unstable legislation, expensive technology and uncertainty about future energy prices reduce investor motivation and slow down funding for new green projects.

On the other hand, energy companies are driving themselves into a corner by pursuing low energy prices.

Fierce competition in the renewable energy market has recently led to a significant decrease in the return on investment and the profitability of green projects in general. Some companies in 2020-2021 experienced a 1.5-fold decrease in ROI, which became a serious test for the sector.

The rise in the cost of materials plays an important role in reducing the profitability of projects.

Taken together, all of the above jeopardizes ambitious energy transition plans, requiring the introduction of new financial models.

Nevertheless, most countries with insufficient fossil fuel reserves are successfully meeting the challenges of the global energy transition. The United States, the Netherlands, the United Kingdom, Japan, Germany, Spain, France, Poland, and some developing countries including China, Mexico, Brazil, Chile and Ukraine have achieved the greatest successes.

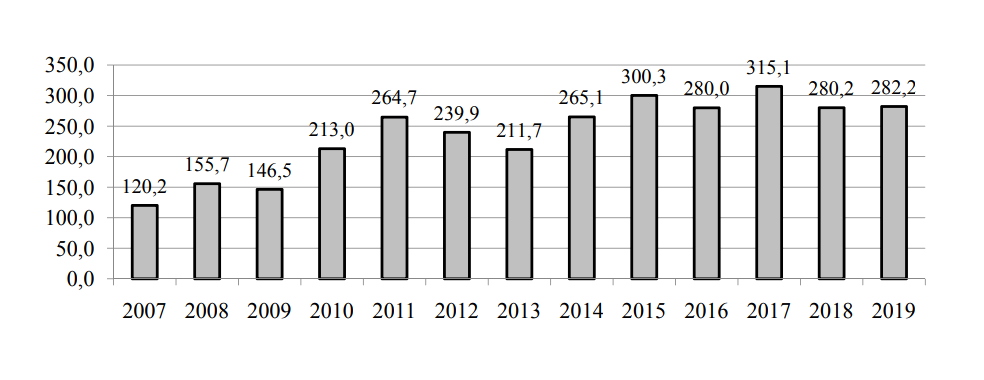

The chart below shows the cumulative global investment in green energy projects from 2007 to 2019 (billions of US dollars) according to BNEF, 2020.

In 2015, the share of renewable energy sources in the global energy sector was only 28%, significantly inferior to fossil fuels.

According to experts' forecasts, by 2040 the share of renewable energy sources will exceed 65%, which will make them the main source of electricity and ensure sustainable growth of the world economy. A global green transformation strategy resilient to environmental and regulatory risks requires more active financing of carbon-free renewable energy investment projects.

Renewable energy investment cycles

The investment cycle of a project refers to the period of time from the moment the final investment decision (FID) is made to the moment the power plant is put into operation.When planning an investment strategy, it is important for management to consider the duration of investment cycles for each technology.

This cycle determines the choice of the best sources and models of project financing (long-term loan, bond issue, leasing), the choice of specific equipment and the most suitable contractors, the adaptation of engineering and technical documentation, planning of construction works and much more.

The investment cycle of a project is especially important for participants because a clear understanding of the time frame of a project allows management to accurately match credit flows, project milestones, and debt service schedules. The table below lists typical investment cycles for major renewable energy technologies used in both electricity and heating.

Table: Approximate duration of renewable energy investment cycles.

| RES project type | Energy source type | Cycle duration, years |

| Power generation projects | Photovoltaic solar power plant | 1-2 |

| Onshore wind farm | 3-4 | |

| Offshore wind farm | 4-5 | |

| Biogas power plant for farming | 2 | |

| Heat supply projects | Solar thermal collectors | 1 |

| Geothermal heating projects | 5 | |

| Biomass combined heat and power plant | 4-5 |

It is important to consider investment cycles when financing green energy projects in developing countries, where bureaucracy and corruption can have a negative impact on project timing.

In addition, in the period 2020-2021, some administrative procedures became more complicated and took longer due to the consequences of the COVID-19 pandemic. This should also be taken into account by the project participants.

If you are looking for affordable sources of financing for the construction of a solar power plant or wind farm, contact our representatives. Our team will carry out calculations for a specific project as soon as possible, choosing the optimal financial model.

We will provide comprehensive financial, legal and technical support for your project.

Decision on financing a renewable energy project

Any renewable energy projects, including zero-emission sources, are characterized by high capital costs (CAPEX) and very low operating costs (OPEX).Such investment projects do not depend on the supply of fossil fuels, but require high initial investments at the stage of engineering works, construction and equipment procurement. Consequently, their development is largely associated with access to stable sources of funding.

Currently, throughout Europe and the world, there is an increase in the share of renewable energy projects in the energy sector, which is accompanied by a gradual decrease in investment cost and a reduction in the investment cycle. Today, thanks to new organizational solutions and well-developed technology, an investor can receive stable cash flows within 2-3 years after the final investment decision is made, when it comes to medium-sized photovoltaic or wind energy projects.

The currently observed increase in the installed capacity of such energy sources will stimulate bolder investment decisions in power generation and heating systems.

This will also contribute to the decarbonisation of the energy sector, which in turn will lead to lower energy and heat prices for consumers and the entire economy.

In the short term, projects based on technologies with short investment cycles and low operating costs will be of the greatest interest to investors. Typical solutions are the financing of solar projects or the construction of medium-sized onshore wind farms, as well as so-called green energy to heat projects (for example, the use of solar collectors and biomass for heating residential buildings and industrial facilities).

Offshore wind farms play an important role in the medium term. However, the implementation period for a large wind power project can take about 4 years. The long investment cycle can be explained, first of all, by technical difficulties in the construction and calculation of offshore facilities. Despite the risks, it is currently one of the cheapest renewable energy sources in the Nordic countries.

With regard to long-term projects for biogas power plants and heating systems, such projects face a long investment cycle. In addition, it is very difficult for an investor to predict the availability and price of a substrate for biogas production for 10-15 years ahead.

The latter is very important to consider in the context of long-term energy supplies.

If you require professional investment advice on renewable energy issues, contact Link Bridge Financial LTDA. We will gladly help you develop an optimal financial model for a new investment project.

Sources and models of financing green energy projects

Choosing the right sources and methods of financing is the key to the successful construction of wind farms, solar power plants or geothermal projects.This issue is becoming more and more important when planning renewable energy investments amid market saturation and growing competition between green energy suppliers.

While renewables have lost much of their popularity among small private investors over the past 8-10 years, they are enjoying growing interest from institutional investors. The financial sector now offers important know-how for projects in wind, solar and geothermal energy. These solutions most often relate to the financing of mega-projects that require a combination of several sources of financing at once, such as bonds, leasing and syndicated bank loans.

Meanwhile, new partners are entering the renewable energy market, opening up new sources of funds. In European countries, for example, banks provide less capital for such projects. Instead, other players, such as large insurance companies, are showing increased interest in such debt.

The low profitability of green projects in the region of 6-9% per annum is quite suitable for European insurance companies that prefer a long investment horizon and stable cash flows.

Bank loans remain an important source of borrowed funds for the construction of large power plants, accounting for more than half of total investments in many renewable energy projects.

Commercial banks today are more careful in selecting projects for financing and have stringent requirements for securing loans, but this instrument generally remains one of the fastest and most affordable for energy companies.

Below we will look at some of the sources of financing for green energy projects.

Bank loans in the host country

Long-term loans from commercial banks are a common source of financing for renewable energy projects.These are usually local banks and branches of large multinational financial institutions that have deployed in the host country. Many of them set up special units that finance green projects or open subsidiary banks under a new brand specifically for this purpose.

Due to the sufficiently high liquidity, specialized banks are willing to lend to large, high-quality renewable energy projects. The advantage of such financial institutions lies in excellent market knowledge and a well-developed approach to the selection and control of projects. Banks that focus primarily on green energy finance offer more attractive solutions and generally demonstrate greater flexibility in dealing with key players in the sector.

In some countries, banks are forced to overcome artificial barriers to financing renewable energy, set by the clumsy state machine.

For example, tight credit risk limits often reduce a bank's ability to finance large projects.

For various reasons, not all banks are ready to offer adequate rates for the development of this sector. In each case, it is important to ensure that the host country's financial system maintains a delicate balance between risks to the banking system and growth opportunities for renewables.

Looking for a reliable capital provider?

Link Bridge Financial LTDA offers large bank loans from 50 million euros with maturities up to 20 years, adapted to the needs of the green energy sector.

Loans from international financial institutions

World Bank Group financial institutions such as the European Bank for Reconstruction and Development and the International Finance Corporation, along with the OPIC (Overseas Private Investment Corporation) structures, are currently offering large loans for the construction of wind farms and other green energy projects.Chinese financial institutions, including the China Development Bank, are also showing increased interest in financing renewable energy sources in developing countries. These players largely determine modern opportunities for the development of green energy, increasing their share in this sector.

Taking on high investment risks, Chinese banks provide professional support for projects and control over their implementation.

Applying for a loan to international financial institutions requires the development of a high-quality investment project, which is practically impossible for small energy companies without the involvement of outside specialists and expert groups.

Funding through international grants

Given the enormous importance of the green transition for the world's economy, large international financial institutions often provide gratuitous financial assistance for the implementation of strategic projects in this area.This can be both the construction of new power plants and projects of large-scale energy modernization and expansion of existing facilities. Projects are selected through an open competition in order to allocate resources for high quality projects.

Funding for renewable energy sources through international grants is widespread, but serious obstacles to attracting such funding are the lack of professional experience of the applicants and limited resources.

According to various estimates, the share of such funding ranges from 2 to 5%.

Project finance (PF)

Financial experts distinguish three broad categories that combine different instruments for financing green energy projects.These are bank lending, asset-backed securities and project finance. Compared to the early 2000s, the share of project finance instruments in renewable energy projects has grown tenfold, exceeding 30% of the market volume.

This is easily explained by the high flexibility of the PF and the adaptability of the contract structure to the needs of a specific investment project.

The essence of project finance is to raise borrowed funds against the future cash flows of the project. The collateral in this case is the project assets allocated to an independent project company (SPV / SPE). This is off-balance sheet financing that does not affect the creditworthiness of the companies that initiate the project.

Unlike asset-backed securities, project finance is considered more risky for lenders.

However, the PF opens up ample opportunities for the development of long-term projects for companies that are unable to use other financing models.

The financial team of Link Bridge Financial LTDA has extensive experience in project finance services for the construction of solar power plants and wind farms around the world. We are ready to assist the development of your project at any stage.

Financing through energy cooperatives

Pooling financial resources of all stakeholders is becoming a new trend in the green energy sector, driven by the high cost and complexity of energy projects based on innovative and immature technologies.Various forms of cooperation between small consumers, organizations or companies contribute to the implementation of strategic projects, most often at the local and regional level.

This innovative form of decentralized participation of local communities and organizations in energy security and sustainability has become very popular in European countries such as Germany and the UK. According to some reports, German energy cooperatives already generate about 30% of the country's green energy.

According to the statements of European regulators, decentralized or distributed generation of electricity is considered as a full-fledged part of the energy sector of the European Union.

Financing such projects at the local level is becoming a unique phenomenon that opens up new opportunities.

Green bond issue

The so-called green bonds are inextricably linked to the long-term energy goals announced at past climate conferences.The issuance of green bonds allows to attract huge resources for new projects to reduce CO2 emissions.

The benefits of issuing green bonds include the following:

• High transparency of financing.

• An ideal way of communication between the issuer and investors.

• Attracting a wide range of investors to renewable energy projects.

• Effective management of climate risks.

The total volume of green bond placements in the first half of 2021 reached $ 227.8 billion.

Total issuance in previous periods exceeded USD 2 trillion, making green bonds one of the most powerful renewable energy financing instruments in history.

However, it should be noted that the widespread use of this tool presupposes the introduction of more stringent regulatory norms and standards. It also requires a highly developed stock market based on stable national legislation.

Financing renewable energy projects through an EPC contractor

A large EPC contractor implementing a green energy project may provide funds for the construction and launch of the facility.This approach is especially interesting for small customers who want to shift risks onto the shoulders of a single contractor and minimize their participation in the project.

In this case, it is critical to find a partner with a strong financial base who is able to fully provide the project with the necessary resources on adequate terms. Our team is ready to help you with the implementation of large green energy projects based on an EPC contract.

Experts highlight a number of advantages of financing renewable energy projects through a general contractor. First, well-known engineering companies have extensive business contacts and a good reputation. This contributes to obtaining loans on more favorable terms than could be obtained by small customers. Secondly, a company with experience in engineering and technical services can offer better conditions for the purchase of equipment from some manufacturers and suppliers.

Export credit agencies

A significant part of the investment costs in the construction of green energy projects is the cost of equipment.For example, photovoltaic panels and inverters are the most expensive components in the construction of a solar power plant. It is not surprising that financing the purchase of expensive equipment abroad through export credit agencies (ECA) has become a popular practice.

Powerful ECAs were created under the governments of the United States, China, and industrialized countries in Europe. They promote the products of local companies abroad, offering financing for the purchase of equipment on favorable terms.

This financial mechanism plays an important role in the construction of green projects.

Despite the crisis in the global economy and increased investment risks, there are still no serious problems with attracting external financing for high-quality projects.

The accumulation of knowledge and experience has a positive effect on the progress of the market, so borrowers and capital providers are able to easily find common ground even in unstable market conditions.

Link Bridge Financial LTDA is ready to offer the most flexible solutions for financing your renewable energy project. Our personalized approach and extensive international investment experience will be the key to the success of your business.

Renewable energy financial support and loans

Borrowed funds from international organizations and government support play an important role in financing green energy projects.It can be carried out in various forms, including the allocation of government funding, concessional lending, tax incentives, and so on. Special funds and support programs for renewable energy make a great contribution to this industry, reallocating financial resources to support investments, compensating interest on loans and introducing mechanisms of government and municipal guarantees.

Reallocation of resources at the level of local budgets is crucial for the development and growth of the energy sector in the context of its decentralization.

This contributes to the generation of additional cash flows and the creation of high-paying jobs. Local support for renewable energy also reduces the dependence of communities on subsidies from the central budget and increases the economic sustainability of a particular region in the long term.

In many European countries, along with the use of internal resources to support the development of renewable energy, municipalities attract loans from international financial organizations, banks or other credit institutions.

World experience shows that an effective form of financing green energy projects is the creation of so-called energy service companies, both national and regional.

Energy Service Companies (ESCOs) are implementing energy saving measures using their own or credit funds instead of subsidies and subventions from the budget. Theoretically, they can finance energy generating projects, but in practice the activities of such companies are more focused on the implementation of projects in the field of energy saving and energy efficiency (including the modernization of large consumers).

The role of green bonds

Recently, the practice of financing renewable energy investment projects by issuing green bonds has been spreading all over the world.These are bonds, the prospectus of which provides for the use of the attracted funds exclusively to finance a green energy project or a part of it.

For the first time, green bonds were issued by such reputable organizations as the World Bank, the European Investment Bank, the European Bank for Reconstruction and Development, and the International Finance Corporation. Today, their issuers can be private companies, municipalities or public authorities.

Green bonds as a source of financing for renewable energy projects are of great interest to local communities, since these securities offer municipalities significant advantages over other sources:

• Construction of large-scale solar power plants and wind farms at the regional level, without the involvement of the central budget or national lending institutions.

• An additional source of investment in key sectors of the economy significantly increases the economic potential and competitiveness of the region.

• Green bonds help reduce fossil fuel consumption and local carbon emissions.

In different countries of the world, policies to support the development of the green bond market are implemented in different ways.

For example, the US uses incentives such as tax exemptions for issuers. The government provides subsidies to reduce the interest rate on green bonds. In addition, the authorities offer tax credits for issuers and buyers of securities.

The Central Bank of China does not take green bond loans into account when calculating bank liquidity and assessing bank capital adequacy. Many countries use similar measures to some extent. In particular, the European Commission notes the need to reduce regulatory requirements for loans to finance renewable energy projects in the European Union.

International financial institutions such as the World Bank are also supporting the development of green bonds.

Its structures offer comprehensive assistance to governments in the issuance of these securities.

The International Finance Corporation is helping national governments to develop guidelines and procedures for the green bond market, and the European Investment Bank is helping to develop criteria for the environmental value of renewable energy projects.

Another promising instrument for financing investment projects in the field of renewable energy sources are loans from the so-called revolving funds.

A revolving fund is created to finance a specific area of activity, determined by investors and fund owners. It requires initial direct investment to create it, so it is not entirely dependent on credit funds.

Initial investments for the creation of a revolving fund can come from budgetary funds, as well as from loans from local or international banks, as well as funds from companies, organizations, governments and private investors.

Cooperatives and joint ventures

Today, in the energy sector, there is an urgent need to combine the efforts, resources and interests of project participants, including manufacturers, suppliers, distribution companies and energy consumers.Such cooperation is advisable for both technical and economic reasons.

Renewable energy projects are highly dispersed, and their efficient financing requires economies of scale. Small consumers / producers do not have enough resources, which leads to the cooperation.

The European practice of building solar power plants and wind farms shows that the promising options for the merger are the establishment of joint ventures for the generation of energy from renewable sources. Such projects can be implemented, for example, through co-financing.

Another important area for pooling resources is the establishment of the aforementioned energy cooperatives. These cooperatives are legal entities whose purpose is to produce, store or transport energy resources, as well as provide other services in order to meet the needs of the members of the cooperative or the local community.

An energy cooperative can be created in the form of an autonomous association of private investors, companies and organizations.

Their activities are aimed at the decentralized production and consumption of green energy, independent of energy companies.

Afterword

Today, energy companies focus their efforts mainly on attracting bank loans for the construction of new facilities.The development of renewable energy projects through the issuance of green bonds, leasing and other forms of investment financing also remains important for the growing sector.

Do you need help financing green energy projects?

Link Bridge Financial LTDA has been providing investment services for over 20 years, ensuring the success of large energy projects around the world.

Contact us to find out more.