To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Financing compound feed plants involves a professional approach to financial modeling, choosing capital sources, negotiations, project management and other aspects.

This requires a high quality system of credit guarantees, analysis, monitoring and management of investment projects to ensure successful investments.

In recent years, the growing strategic role of project finance in the animal feed industry has spurred the development of research and the emergence of new models aimed at off-balance sheet financing with high financial leverage.

A key role in ensuring the success of the project is played by comprehensive strategic planning for the activities of a particular company engaged in the production of animal feed. A well-thought-out strategic plan also plays a big role in the choice of sources and models of financing for the construction or modernization of a compound feed plant.

Project finance refers to an innovative system of financing large projects, which is mainly used for investments of tens of millions of euros and more.

Unlike traditional corporate lending, where loan funds can be used for financial and economic activities of the borrower, project finance is organized around specific projects (investment, innovation, leasing, concession, etc.).

In this case, the assessment of the borrower's activities is determined as part of the overall assessment of the investment project. Based on this, the source of debt repayment within this financing structure is the cash flow generated by the project, while in investment lending the source of debt repayment is the income of the borrower.

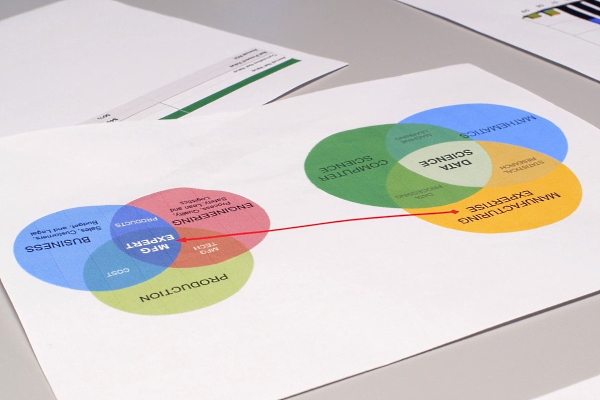

The complexity of organizing project finance (PF) schemes involves a long period of preparation, as well as the need for a wide range of engineering, financial and legal services of various companies involved in project.

Project finance for compound feed plant: characteristics, stages and risks

Project finance is a mechanism for attracting long-term debt capital for complex projects using advanced financial engineering tools, based on future cash flow that will be generated by the compound feed plant.Unlike other methods of business financing, PF forms a comprehensive system that combines all aspects of project development. Project finance is a complex integrated activity that combines organizational, legal, financial and engineering aspects.

Project finance of compound feed plants consists of the following stages:

• Initiation of the project, which involves the design of the project at the level of the idea and the presentation of the idea to potential participants.

• Project due diligence, which is carried out using the services of highly specialized teams.

• Stage of preparation and development of the project, which actually means the design of the idea in the form of funding schemes, organization, engineering solutions.

• Project implementation phase, including the creation of a project company (SPV), tenders, procurement of equipment and execution of works.

• Stage of implementation and monitoring, including contractual support, which regulates the aspects of obtaining and distributing profits, ensuring the return of capital, distribution and minimization of production risks.

• Stage of completion and transfer of the facility after a certain period and transfer of the plant to the operator if such transfer did not take place in the initial stages of the project.

The predominant trend in project finance in industrialized countries is the use of a wide range of sources and methods of financing investment projects, including long-term bank loans, securities issues, equity contributions, corporate loans, bond loans, financial leasing and internal resources (including depreciation funds and retained earnings).

An industrial company is a full participant in PF schemes for compound feed plants. To ensure closer coordination of participants and increase the efficiency of the project team, consortia are created and agreements on production, commercial and financial cooperation are signed.

General characteristics of project finance include the following:

• Implementation of a self-sufficient project by creating a separate legal entity (Special Purpose Vehicle), which specializes in a particular field and is limited by the project.

• Development of a new investment project or complete modernization of an existing facility.

• High share of external financing, which in some cases reaches 90% of the total project cost.

• Ensuring adequate debt repayment using project-generated cash flows.

• The income of creditors comes from future profits, not from current assets of the company.

• The main guarantees of debt repayment are contracts, licenses and / or patents issued to the project company. In particular, technical licenses or various property rights.

• Limited project life cycle: compound feed plant usually has a long life cycle, while funding is attracted by participants according to an agreed schedule, including changes in the rights of participants at different stages of the life cycle.

Of particular note is the crucial role of SPV in the organization of project finance schemes.

In particular, an independent company with separate assets from the participants is the only borrower that guarantees the repayment of debts from future financial flows. Loans are secured by the assets of the project company and the future plant, which minimizes credit risks for participants. Contracts concluded by the project company not only determine the term of the project, guarantee the return on investment, but also ensure the diversification and risk sharing of PF participants.

The basic principle of project finance is the transfer of risks to those project participants who are most competent in assessing such risks and minimizing them.

The generally accepted approach is to impose a minimum of risks on the project company, because in case of adverse events will be a direct path to the bankruptcy of SPV and project failure. Thus, the risks are shared among a large number of parties, including creditors, engineering firms, suppliers and others.

There are legal instruments for minimizing creditors' risks and securing the project's cash flow:

• Obligations imposed by the loan agreement on the borrower or other parties to such an agreement, for example, the obligation not to change the terms of the contract for the construction of the facility without the consent of the creditor.

• Direct contracts, the parties to which undertake certain obligations to creditors (for example, the owners of the SPV undertake to cover a possible shortfall to complete the construction of the compound feed plant).

• Documents to secure a loan, such as the provision of an adequate collateral or even assignment of claims under certain supply contracts.

In some industrial projects, public funds can be used, sometimes in the form of government loans and subsidies, but more often in the form of guarantees / tax benefits.

Not only commercial banks, but also investment banks, investment funds and companies, pension funds and other institutional investors, leasing companies and other financial, credit and investment institutions can act as financial participants in the implementation of large investment projects.

An important issue in project finance is political risk.

It is obvious that the party best suited to reduce political risks is the state, represented by its respective bodies. In global practice, the financing of large industrial projects often involves the conclusion of direct agreements with the competent government authority (Host Government Support Agreements), under which the state undertakes mainly non-financial commitments to support the project being funded.

Link Bridge Financial LTDA has brought together a multidisciplinary team of experts with extensive experience in international project financing and consulting services.

We are ready to offer our corporate clients flexible schemes for long-term lending, project finance, as well as guarantees and project support from A to Z.

Contact our representatives to find out more.