To consider an application for financing, fill out the form and send it to us by e-mail along with the project brief, or contact our experts

Financing large projects requires the use of new financial models that best meet the growing business requirements and the changing conditions of a highly competitive global market.

Link Bridge Financial LTDA offers a full range of financial, legal, engineering solutions required for the successful implementation of large projects in Canada, the USA and other countries.

Together with respected partners from different countries, we have participated in the construction of large wind farms, substations, mines, roads, waste processing plants, chemical plants and other facilities.

Are you interested in project finance (PF) services in Canada?

Our professional team is ready to organize project finance (including SPV registration), as well as assist in obtaining a long-term investment loans and debt refinancing.

Contact us to find out more.

Sources of financing investment projects in Canada

Finding sources of financing for large investment projects in Canada presents certain difficulties for companies, especially against the background of uncertainty and risks of recent years.Project finance laws and regulations in Canada today contribute to the effective development of large projects using advanced financial instruments.

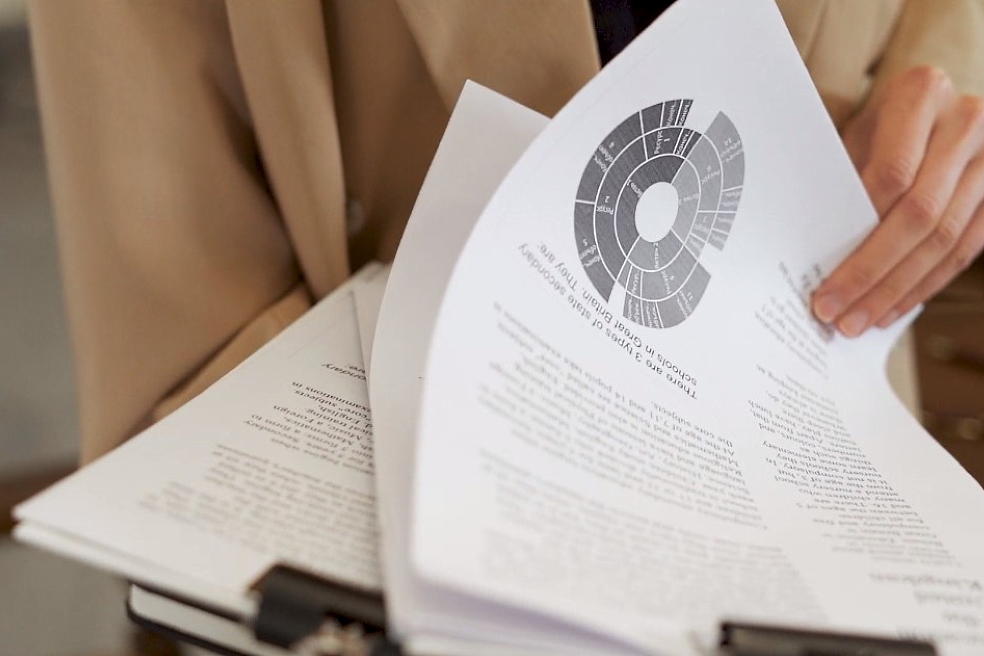

Financing of investment projects is carried out during several stages of the project life cycle, both in the pre-investment stage and in the investment and operation stages of the project. The relationship between the business processes of the commercial bank and the life cycle of the project is presented in the table below.

Table: Processes of financing an investment project at different stages of the life cycle.

| Project life cycle | Processes associated with an investment project |

| Project development (pre-investment stage) |

Analysis and expert assessment of the project. Making a decision on participation in the project. Organization of financing. |

| Project construction (investment stage) |

Construction financing. Project monitoring. |

| Operational stage |

Financing the operation. Performance monitoring. Preparing to exit the project. |

| Closing a project | - |

The decision to involve a bank (or any other investor/lender) in a project is made on the basis of a detailed project analysis and assessment of the effectiveness of investment projects, taking into account the investment policy adopted by the bank.

Canadian banks and other financial institutions impose a variety of requirements for projects to be financed. After making a decision to participate in an investment project, the bank begins to select the most appropriate instruments and forms of financing in the context of the structure of a particular project.

Investment projects in Canada are always implemented not only for the rapid development of business, but also with high environmental requirements and social responsibility.

Any large project in this country, especially those involving the use of natural resources, goes through a number of inspections and assessments by the government before official permits are issued. This often increases the cost of the project and requires accessible and long-term sources of funding for its implementation.

Of the variety of medium- and long-term financing instruments for investment projects in Canada, local and foreign companies can use both simple single-instrument schemes (such as an investment loan) and complex financing schemes using a combination of different instruments.

How do you determine which instrument is most beneficial to the financier (bank, leasing company, investment fund)?

Which instrument will be preferred by the financial director of the company implementing the project?

The criterion for choosing a project financing tool and its parameters depends on the interests of the owners of the company implementing the project.

In most cases, the goal is to maximize an increase in the market value of the company in the interests of shareholders. If the implementation of an investment project with the use of certain financing instruments yields the largest increase in the market value of the company, such financing instruments are preferable.

For companies implementing infrastructure and other projects in the interests of the state and with the participation of the Canadian government, the most important criterion is the environmental or social effect. If the economic effect is considered a priority for PPP projects, the participants focus on the increase in the market value of the company in the interests of the government as a shareholder.

The Canadian government is currently investing huge sums in infrastructure and environmental projects across the country.

As part of the Investing in Canada plan, the government invests more than $180 billion over several years, supporting transportation networks and hubs, social infrastructure, health care, innovative industries, the environment and other areas.

In particular, government funding for infrastructure projects in Canada is provided through the Canada Infrastructure Bank, as well as through a number of government agencies and entities (Health Canada, Heritage Canada, Infrastructure Canada, etc.).

In Canada, most large projects involving the state are characterized by high capital intensity and a long payback period. For such projects, regardless of industry or regional affiliation, a combined approach to financing investment projects is usually used. Project finance (PF) is one of the most important ways of financing such projects.

Project finance in Canada: organization of services

If we trace the evolution of the definition of project finance, we can highlight the main features of this form of financing investment projects.The most famous experts in the field of project finance are Peter K. Nevitt and Benjamin Esty.

Canadian financiers provide several definitions of project finance. PF can be considered as lending to the borrower for the implementation of an investment project without recourse or with limited recourse to the borrower, where the main collateral is the future cash flows of the project. According to Benjamin Esty, project finance is a way to mobilize various sources of financing, using a variety of instruments in an integrated manner to optimally distribute risks.

The following are the key motives of using PF in large projects:

• SPV lenders rely only on project assets and cash flows to recover the debt.

• High share of borrowed funds, reaching up to 80% of the project cost (Link Bridge Financial LTDA offers project finance services in Canada, providing up to 90% of the project cost).

• An opportunity for companies to create several project companies to implement a portfolio of projects and transfer project risks off the balance sheet of this company.

• Reducing the so-called "agency costs".

The most important feature of project finance is that the participants create a special design company (SPV – special purpose vehicle), which attracts resources, implements the project and settles with the lenders and investors of the project from the cash flow generated by the project.

The second feature of project financing is that borrowers do not provide their assets to ensure the return of the borrowed funds received.

The return of the borrowed funds raised by the SPV is ensured by the cash flow generated by the project.

Assets created (acquired) in the future can be used as collateral.

The latter feature makes PF the most risky form of project financing.

The third feature of project financing is the use by providers of financial resources for the project of various financial instruments (equity, debt, derivatives) and various types of contracts. Taking into account these three features, the following definition of project financing can be given: a multi-instrument form of financing of a specially created company for the implementation of a project (SPV), in which the future cash flows of the project are the main security for the return of borrowed funds and the payment of income to investors.

Project financing is based on forecasts of the future development of the project and the project company, depends on the efficiency of the project company and the effective implementation of the project. In project financing, the development strategy of the project and the prospects for the development of the corresponding business are important.

The third feature of project finance is the use of various financial instruments and various types of contracts. In project finance, the most important thing is the correct project development strategy and the prospects of the relevant business (sector).

Project finance in Canada is a highly effective tool for the implementation of infrastructure projects, construction of power plants, mining and processing of minerals, and wastewater treatment.

This is facilitated by a highly developed financial market, stable legislation, effective government support for strategic projects, predictability of investment and business conditions.

Project finance services in Canada are characterized by the following features:

• Comprehensive analysis and sharing of risks between stakeholders and their monitoring.

• The use of complex financial indicators characterizing the "margin of safety" of the project.

• Selection of suppliers and contractors based on the results of transparent tenders.

• Wide opportunities for complex monitoring of the investment project implementation.

• The high activity of the Canadian government in the development of infrastructure and energy sector creates additional opportunities for the use of project finance.

The first deal, which later became known as project finance, took place in the 1930s in Texas (USA).

Pioneered in the highly lucrative oil business, project finance developed rapidly from the 1970s to the 1990s in the energy and key public infrastructure sectors, and was widely used in Canada and other developed countries to expand mobile telephony.

The most important drivers of the development of project finance at the beginning of the 21st century were the globalization of the investment market and the privatization of public infrastructure enterprises in most developed market countries.

Today, many projects in this area are carried out through the PF instruments with the direct participation or assistance of governments.

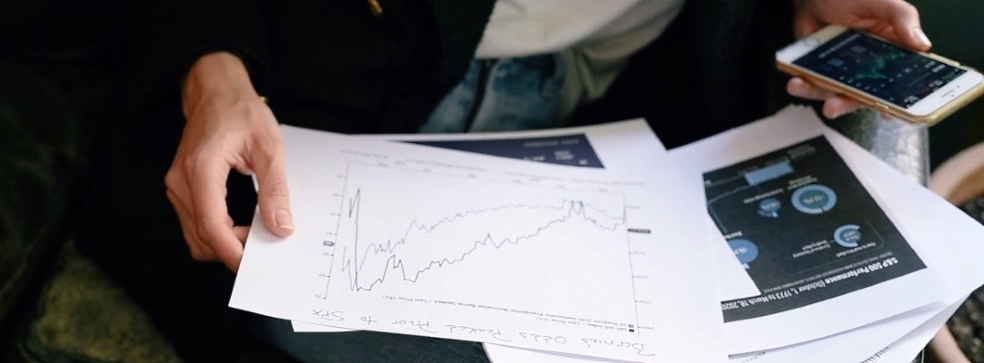

According to the international magazine IJGlobal, the global project finance market has more than tripled from 2001 to 2008 and amounted to $ 193.5 billion at the end of 2008. In 2009, as a result of the global economic crisis, the PF market shrank by 41% and amounted to $ 115 billion.

This reflects the high sensitivity of potential investors to the health of the market, the dominant factor in making decisions about participation in large investment projects based on PF.

In the last pre-crisis year of 2019, global project finance market surpassed $ 296 billion, demonstrating phenomenal gains in the energy and infrastructure. The PF market in North America reached $ 94 billion, with most of the investment projects being implemented in the energy sector.

PPP as a form of project finance in Canada

PPP is defined by the World Bank as any contractual or legal relationship between public and private entities for the purpose of improving and / or expanding services in the public sector, excluding government procurement contracts.The term "state" in the framework of public-private partnerships is used to refer to any level of public authority (national, regional or municipal level).

PPP financing schemes in Canada share all the features of project finance, including the presence of a dedicated project company, the use of generated cash flow to repay debt, and the use of a complex multilateral system of financial instruments and contracts. Therefore, public-private partnership can be called a form of project finance. However, PPP projects can often be implemented in practice using simpler instruments and forms of project financing.

PPP projects in Canada are predominantly large public projects of great social importance in the areas of infrastructure, environment, culture, health, education, as well as small municipal projects.

Many of them are being implemented as part of the Investing in Canada Plan, initiated in 2016. The peculiarities of such projects are considered to be a long implementation process and low commercial efficiency.

In general, Canada is traditionally considered one of the world leaders in the field of public-private partnerships. Over the past decades, PPP Canada and local agencies have successfully implemented dozens of major infrastructure projects in British Columbia, Quebec, Alberta, Ontario, New Brunswick and other provinces, with tremendous efforts to develop the public sector.

Public-private partnership projects include the following:

• Construction (reconstruction, modernization) of large facilities carried out in the public interest, including urban and sectoral development, strengthening of defense, improvement of public administration, etc. or to perform functions.

• Public projects using private capital, which are recouped through the commercial operation of the facility or payment for services provided with its use by a public customer.

• Projects that use the financial resources and competence of private business to fully or partially cover the risks of design, construction and operation.

• Public projects that use funds from the state or local budget, legislative framework and other public prerogatives for the rational distribution of project risks that fall within the competence of state or municipal government.

A prime example of an infrastructure project implemented in Canada through a public-private partnership is the 8-mile Confederation Bridge (Pont de la Confédération), opened in 1997 in the province of New Brunswick.

This unique project, which has become the longest and most technically advanced bridge in Canada, required about 1.3 billion Canadian dollars. Over the past 30 years, the Canadian government and local authorities have implemented more than 200 major PPP projects, mainly in the provinces of British Columbia, Alberta, Quebec and Ontario.

During the presidency of Justin Trudeau, the implementation of infrastructure projects based on public-private partnerships accelerated. In 2017, the government created Canada Infrastructure Bank to support potentially profitable community projects, subsequently disbanding PPP Canada.

Today more than 20% of all new infrastructure in this country is developed, built and managed by the private sector.

Project finance services in Canada today are developing intensively, providing an inflow of private investment for the implementation of capital-intensive projects in various areas.

The mechanisms for implementing such projects have many characteristics in common. The grantor and the project company enter into various types of agreements that best suit the specific project (service contract, management agreement, lease agreement, concession type agreements, full privatization). According to the concession agreement, one party undertakes to create or modernize the object of the concession agreement, to carry out activities with the use (operation) of this object.

The ownership right to the object of the concession agreement belongs or will belong to the other party, and the grantor transfers to the concessionaire the rights to own and use the object of the concession agreement to carry out the specified activity for a certain period.

An important feature of modern PPP projects is a thorough, comprehensive and professional monitoring of the economic effect (value) obtained as a result of the implementation of the project on the funds invested by the state ("value for money" concept).

This concept is used by municipalities in the UK, EU countries, USA and Canada.

Table: Brief description of the main models of PPP contracts in Canada.

| Model | Type and conditions of the contract |

| DB | design–build |

| BOOT | build–own–operate–transfer |

| BOT | build–operate–transfer |

| BTO | build–transfer–operate |

| GOCO | government–owned–company–operate |

| COGO | company–owned–government–operate |

| DBFO | design–build–finance–operate |

| LROT | lease–renewal of concession–operate–transfer |

| OM | operate–maintain |

| BOLT | build–own–lease–transfer |

The most commonly used public-private partnership models in Canada include BOOT (build-own-operate-transfer), GOCO (government-owned-company-operated), and COGO (company-owned-government-operated).

However, other models are also widely used in various fields.

The objects of the concession agreement can be the following:

• Highways and engineering structures of transport infrastructure, including bridges, overpasses, tunnels and vehicle parking.

• Railway transport facilities, including railway bridges and stations.

• Pipelines of various types and purposes.

• Sea and river ports, including hydraulic structures of ports and other facilities with their production and engineering infrastructures.

• Sea and river vessels, as well as icebreaker support vessels, scientific vessels, ferry crossings, floating and dry docks.

• Airfields, buildings and structures intended for takeoff, landing, parking and storage of aircraft, as well as industrial and engineering infrastructure of airports.

• Dams, reservoirs, hydroelectric power plants and other hydraulic structures.

• Facilities for the production, transmission and distribution of electrical and thermal energy for industrial, household and other needs.

• Utility infrastructure systems and other utility facilities, including water, heat, gas and energy supply facilities, wastewater treatment plants, factories and landfills for the processing and disposal of household waste, etc.

• Metro, trolleybus routes and other public transport.

• Hospitals and other facilities used to carry out medical activities.

• Parks and other objects for recreation of citizens and tourism.

• Educational, cultural, sports and other projects.

Link Bridge Financial LTDA is ready to assist in the implementation of large investment projects, including project finance services in Canada and long-term bank loans on flexible terms.

We also negotiate with project participants and provide professional consulting services.